Net 30 vendors have become staples of modern credit building. Newer enterprises search for companies that help build business credit on a regular basis. In today’s market, a company without good credit is at a severe disadvantage. The opportunities available to them become more limited, and they encounter residual problems qualifying for financing.

Ironically, finding vendors that can help a business build their credit score isn’t easy. “Net D” stands for “Net Days”, and is represented by “Net 10”, “Net 15”, “Net 30”, “Net 60” or even “Net 90” for big purchases. (Usually a 90 day invoice is only for large companies.

Let’s discuss exactly how Net 30 vendors work and why you would use them.

What Are Net 30 Vendors?

To clarify, it is important to understand that Net 30 vendors are not credit repair companies. These companies are simply vendors of goods or services that provide invoices for extended payment terms. They allow companies to purchase from them and pay what is owed within a set amount of time. In this case, it would be 30 days from the date of purchase. (Net 30)

The reason that it is important to distinguish between a vendor who offers payment terms and a credit card repair company is subtle.

They both offer an opportunity to better your credit, but they both have different intentions. A credit repair company wants to repair your credit. A Net 30 vendor wants to be fully paid in 30 days or less.

Also, there are specific qualifications that most Net 30 Vendors want you to have before applying for their payment terms.

What Qualifications Do I Need For Net 30 Vendors Approval?

Some vendors have higher requirements than others, so these aren’t the default expectations from companies. However, it is important to find out exactly what the vendors require so that you can qualify for the Net D financing they offer.

- Minimum time in business. (Could be 30 days or even 90 days minimum in business or longer)

- Sign-up fees.

- Maximums for Net 30. (Amount that can be placed in an invoice)

- May require personal credit checks.

- They may also want you to have a D&B number or profile.

What Kind Of Net 30 Vendors Are Available?

There are many kinds of net 30 vendors available today. There are as many Net 30 vendors as there are industries.

The more common net 30 vendors include:

- Design & Branding services.

- Office Supplies.

- Technology & Equipment.

- Promotional Items & Apparel

There are many more kinds of Net 30 vendors. One only has to find a vendor and inquire about their Net 30 financing to determine what they offer.

How Is Net 30 Different Than A Credit Card?

Net 30 is not a line of credit, or a credit card. It is more similar to an invoice or a promise to pay for something purchased. You are technically buying something from a vendor with credit, except you are buying something with a written agreement.

You agree to pay for what you’ve purchased within the set terms. Unlike a credit card or line of credit, the vendor doesn’t get paid in full at the time of purchase.

When a purchase is made through a credit card, the vendor receives full payment from the credit card company used by the buyer. After making the purchase, the buyer now owes the credit card company who have already paid the vendor on the buyer’s behalf.

There is no middle man or intermediary party when Net 30 is used. The buyer agrees to pay, and the vendor expects to be fully paid in the set term duration.

This will improve the buyer’s credit score when they fully pay what is owed. Or it will decrease their credibility if they default on the payment.

What Does A Business Need To Apply With A Net 30 Vendor?

It is critical that you setup your business with the proper legal structure and information.

- To apply, you need to have your business filed as a separate legal entity. (Corporation, LLC, Partnership, etc)

- We recommend acquiring a “Certificate Of Good Standing” from the Secretary of State’s office. It is highly advisable that you have this as proof that you have taken care of all legal responsibilities and filing.

- EIN (Employee Identification Number). This should have been created for your company during or after filing as a corporation or some kind of legal entity.

- Although certainly not a critical item to consider, a separate business address from your own (if you run your business from your personal address) could be a good idea. It is also ideal that you have all necessary business information and contact details ready to submit to any Net 30 Vendor.

- A Business Bank Account. Believe it or not, many companies still flow their profits into a personal account. This is not only risky (due to liability risks) but it also is frowned upon since most want to see your company operating with a business checking account.

Make Money Improving Credit

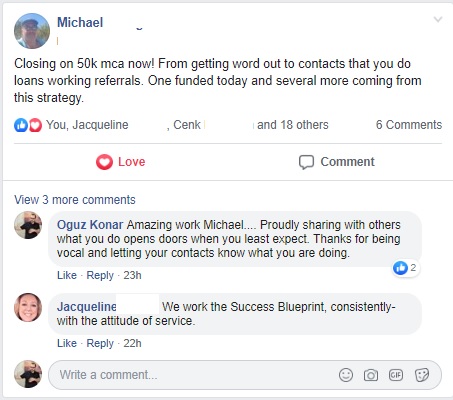

Believe it or not, there is actually a profitable market for anyone who can help companies improve their credit and acquire creative funding. Here at Business Lending Blueprint, we teach people how to become business loan brokers and make 6 or even 7 figures a year. Through our proven “Blueprint” we have helped people of all economic situations and education levels break free of their jobs and become financially free.

Furthermore, we have never stopped growing. We continue to create new ways to capitalize on the markets, just like we did during 2020. Our students flourished while businesses and employees were going under.

If we haven’t met, my name is Oz Konar, and I’m the founder of BLB. I have developed a 70 minute, free training video which details everything you need to know about this opportunity. From start to finish, you will fully grasp what it means to be a loan broker, and determine if this is right for you.

Click the button below and watch the video now. (By the way, if you can’t devote 70 minutes to watch a free training video, then you probably aren’t serious about getting financially free)

I’m not offering a free ride, this business model takes work, but our students will testify that the Blueprint works!

Join the revolution!

Oz