Have you ever heard of a business that thrives no matter the economy, technology growths, Geo-political changes or even a lack of staff? The most immediate companies that come to mind include, Google, Apple, McDonald’s, Chevron, Amazon, Walmart, and a few others. These mega-corporations are practically the commercial staples of Western culture. (No matter your political beliefs, shopping patterns, or living conditions, you have heard of one or more of these companies) But what do all of these companies have in common? They all use money to function. This is why a multitude of people have enrolled with us to learn how to become a commercial loan broker. Because no matter if we’re in a good market or a bad one, businesses always need money.

To further preface what I will be talking about in this article, did you know that 31% of businesses closed in 2020? That means thousands of jobs were lost in a single year. Business lending is highly in demand right now! Not only do businesses need money to stay afloat in this economy, but the businesses that are doing well in this market need more money to expand! (60% of businesses use loans to expand their operations with more inventory!)

Go Beyond Learning How To Become A Commercial Loan Broker!

The idea that you can make money simply by connecting certain lenders to a business that needs money isn’t complicated, but it generally a foreign concept to the public. Most business owners or rising entrepreneurs will immediately recognize charging money for a service or product, but in this case, our service is to connect a business with another service.

This “middleman” activity is so underrated! You don’t need certification to become a business lending broker, and you don’t even have to have the money that clients need.

If you have done any research into this niche, you may already know how dangerous it can be if you are the one lending the money. Some courses and companies teach that you need to open a risky credit card, and or get certified as a lender for legal reasons.

This is absolutely a terrible strategy!

Why Enroll In A Commercial Loan Broker Training? Why Not Just Lend Out Money Personally?

There are a number of reasons why it is 100% better to be a lending broker, than a business money lender.’

- You need a sound business structure to ensure that you don’t lose everything should a client default on their loan.

- Using your own credibility to get a credit card or loan for someone else can often hurt your reputation and credit score simultaneously.

- You have to become legally certified to become a lending company/institution. (This isn’t cheap in many cases either. Banks have to get accredited and certified to give out loans. It is a process)

- Because you aren’t usually making money on commissions or residual profits, you have to do a huge number of deals to sustain this kind of business model. (Whereas a broker can get in and out of a deal very quickly for maximum profits. They can repeat this over and over and have little invested in the deal itself)

So Maybe You’re Wondering How To Become A Commercial Loan Broker And Why It’s Better?

Well, to put it succinctly, becoming the middle man in a transaction has always been an effective way to lower risk, lessen your initial investment, and increase your ROI. (Return Of Investment) Because let’s face it, no one wants to be stuck in a precarious situation with everything on the line. This can be profitable if you have a large operation with the capacity to take on many loans and handle a large number of clients. (Like banks or online lenders will do)

Our system takes advantage of their huge business systems allowing anyone of any education level to get started. (Seriously, this business is very simple. Not only that, but most of our students see sales within 30-60 days of getting started)

Plus, we teach how to structure deals for maximum profits. (E.g. Using one time commissions vs. residual payments)

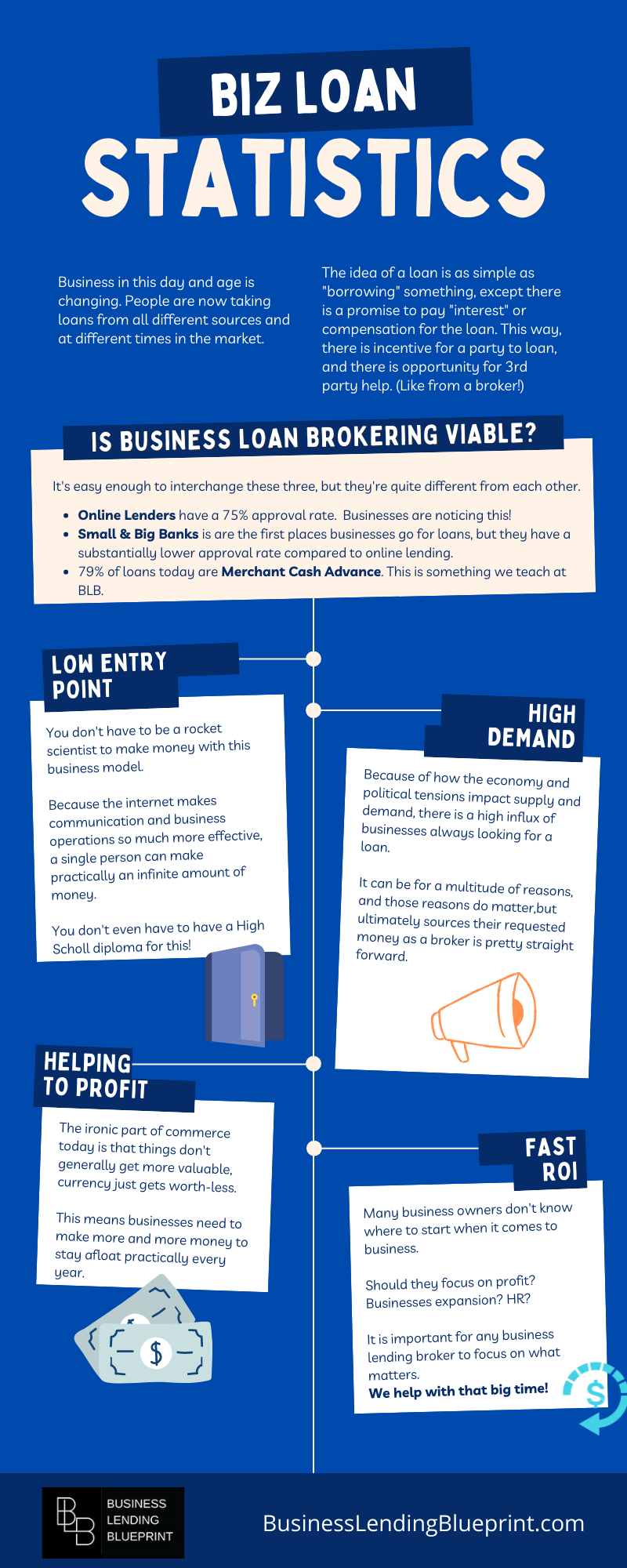

But Can You Really Make A Sustainable Business In This Market? (Infographic)

Yes! Our students regularly achieve success with this business model, pre-pandemic, post-pandemic, pre-recession, post-recession; It doesn’t matter. This kind of business eloquently and effectively flows with the tide that is the economy. That being said, results are going to depend on you, the broker. Closing deals, properly evaluating clients, and structuring each deal well. These are the fundamentals of being a business broker, and we teach our students how to do it all.

We also don’t price gouge you like many of our competitors do. Most want at least 20K to start learning their systems, we charge a small fraction of that and offer way more value. (This isn’t because we don’t believe that our course is worth 20 grand, we just recognize that most people in today’s market don’t have that much money lying around!)

As time goes on, the demand for business funding is growing greater practically every day, and now over 24% of loans are done online. (With a far higher approval rate than traditional loans by banks)

See our infographic below to get an overview of this business model:

What If I’m Not Comfortable On The Phones?

We have training that goes in depth on how to sound amazing on the phones and we also teach ways to work with clients that don’t even require being on the phone.

The same principles of having a personalized marketing campaign without being too personally invested in a client applies here. We aren’t looking to be a “people pleaser” or someone who spends their whole day talking with someone. We teach our students to be “problem solvers”. People who solve the troubles that businesses are facing are far more valuable in the long run. Someone who sounds good on the phone but isn’t very effective getting them the funding they need is going to be forgotten.

Let’s put it this way, we will work with you every step of the way to ensure that you can close a deal and repeat the process. If you aren’t comfortable on the phone, we’ll work with you on that. There’s no such thing as the perfect entrepreneur, everyone works on something.

How Is This Business Really Recession Proof?

You have probably heard of “The Great Depression of 1929” while studying American History. What you may not know, however, is that this economic crash impacted most of the modern world, and it wasn’t only caused from using fiat currency. (E.g. The U.S Dollar used today that isn’t backed by precious metals)

The harsh truth is that the Great Depression happened largely because of how banks were frivolously lending money without a sound method of making that money back. Furthermore, heavy taxes were imposed by the NRA & AAA (later abolished) to try and help raise revenue on the State level.

What’s the problem with that? Well, stacking a worthless currency doesn’t raise the value much, and charging businesses more of it just hurts the economy more. (How is a business supposed to hire help or maintain its infrastructure while heavy taxes are imposed?)

We’ve actually seen this happening in recent years, though the implications of a modern-day “recession” are far more brutal than a 1929 recession.

That’s because the Federal Reserve has been printing trillions of dollars out of thin air, practically every year. (See SomagNews‘ article about this)

And as that article details, $1 in 1913 would buy you what $26.25 could today. (Which is far more than the 2% inflation rates that so called “experts” claim exists today)

So How Does Business Lending Blueprint Fit In?

I’m not trying to fear-monger or tell you the sky is falling. I’m here to show you why you need a recession-proof business model. We don’t know when a market collapse will happen, and when something like that does occur, it’s important to know what businesses can survive.

The reason our commercial loan broker blueprint will thrive in or out of a recession, is because it isn’t dependent on your own financial situation or a single institution’s capacity for loans. We don’t teach you how to be a 1-trick pony, we teach you how to create a business that will last.

One of the primary differences between the early 1900’s and today’s society is that we have this wonderful innovation called the internet. Even in today’s economy, banks don’t have a very good approval rate. More businesses than ever are turning to online lenders and less industrialized sources for funding.

Even though banks are statistically the first place that businesses look for loans, they both have a worse approval rating compared to online lenders.

As a broker, we aren’t the ones lending, we are simply connecting a businesses with the source of the money they need. Even in a recession, this business model will function, and it can even thrive during those hard times!

But Aren’t There Operating Costs?

That’s the funny thing about the internet today, it connects people in ways they may not even realize. And for those who do realize just how much information is downloaded about them, over 70% of people don’t care if businesses have information about them! (You can read our full article about Loan Brokering Business Opportunities and Personalized Offer Here)

It is easier than ever to create a tailored offer for a potential client, and there is usually little to not cost involved. Heck, most of the marketing techniques we teach were designed to work regardless of a person’s budget. (Of course, if you have money to blow, there are ways to use that money for successful marketing campaigns too)

Do I Need To Close A Ton Of Deals To Stay Afloat?

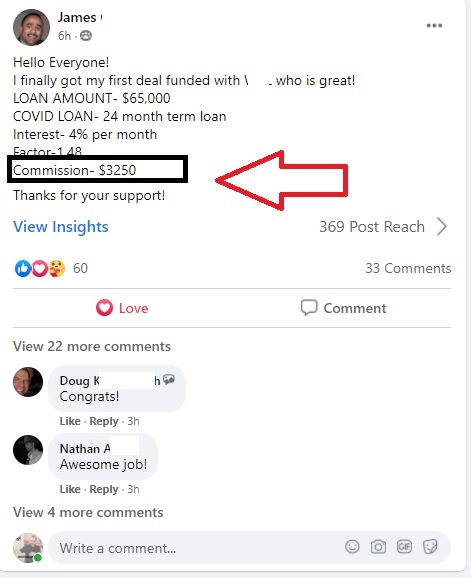

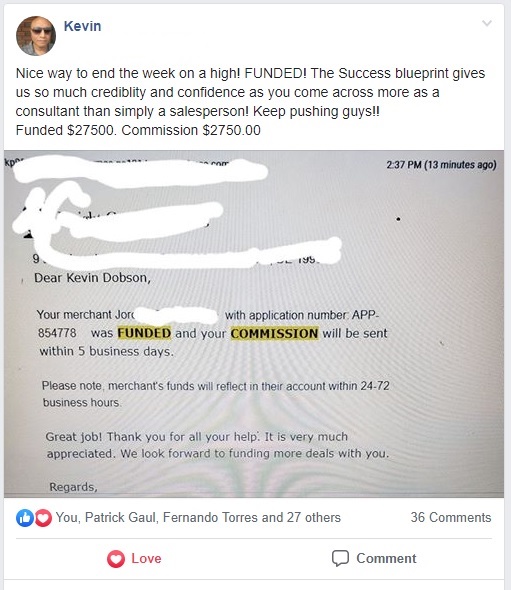

No, you don’t have to close a ton of deals to keep your business running. Many deals give a percentage of the total amount as a commission to you, which means the bigger the deal, the more you will get paid in most cases.

Of course, there are other ways to structure a deal without taking a one-time commission. Residual cash flow can be achieved with specific deals, and some kinds of lending options are faster, which makes it easier to do the little deals.

There are a multitude of various reasons that a business needs money. Those reasons matter, which is why having the right lending option is important. Some loans are better for startups while others are designed to work more effectively for an established business.

Being able to get the money the client needs while structuring the transaction correctly, and profitably, is the core of our training. (It’s also the reason why most of our students make money within 30-60 days of enrolling on average)

How Do I Know If This Business Is Right For Me?

That’s a question that can’t really be answered for you. In fact, the real question you should be asking is, “is a business right for me in the first place?”

Statistics show that 38% of adults believe that entrepreneurship isn’t a good career, and 60% of adults believe that a business is hard to start. Neither of these statistics are realistic, but they do prove a point. Not everyone is cut out to become a successful business owner or business lending broker.

This isn’t a 9-5 job, this isn’t a time-card that gets stamped when you show up. You are the business when you first get started, which means it won’t move forward without you.

Eventually, you can take the business to expanded heights and make it more automated, but that costs more money and experience handling staff. (Or outsourcing freelancers at the very least)

This isn’t about something being “hard” or too advanced, this is about you. It is important to ask the important question that will reveal whether you really want this.

Asking Yourself The Important Questions

This business model isn’t in question, your desire to learn and dedication to a prove plan is. We at BLB teach people of all backgrounds and skill levels to create a recession proof business model, and not everyone gets the same results. Those results are usually determined by the kind of work ethic you have.

That isn’t to say that you should blindly start working on a business that you know nothing about. That’s why we designed a 70 minute training video that we’re giving away for free!

The video will outline exactly how this business model works and how you can use it for maximum profits. We want to make sure that you have your eyes wide open, and are fully on board so that you progress. Because when you succeed it means we’ve succeeded!

And just to preface that video, did you know that a recent study showed that over 90% of people accept legal terms and conditions without reading them? Granted, we’ve all done it at some point, and in most cases we aren’t able to use our favorite services or products without accepting those terms. (So it doesn’t leave us with much choice, huh?)

But this is not a binding contract you must agree to. You have a choice to start this kind of a business, or walk away. Nothing is forced on you, and your life will remain the same if you change nothing.

(And if you are happy with your life why change it?)

Maybe You Aren’t Happy With Your Life?

29% of small business owners start a business because they want to be their own boss. 17% say that they are simply tired of working a job, and 16% say they want to pursue their passions as a career.

Chances are, if you are reading this, you aren’t happy with your life. In some way shape or form, life has dealt you a hand, and you want the dealer to deal you a new one.

That isn’t difficult to understand, nor is it uncommon. People don’t look for change when they are happy, fulfilled, healthy, and excited. Heck, most people look for change because it usually brings them the aforementioned experiences.

Business can be the same way. It is often why so many people will buy a business course and never do anything with it. A study shows that 40% of people who could work, are not working. In other words, they have the means and capability to make their life better, but they chose not to. That is called “laziness”.

Do You Want A Business That Is 100% Autonomous Or Nothing?

I think there are people out there today who are dead-set on becoming a business owner, but are totally against owning a business that requires any involvement from them. A misconception that seemingly never dies is the one of a wealthy business owner who never works a day in his life.

He’s hired a CEO, he has many employees and massive profits. He lives on a beach in the Bahamas and has no reason to enter the corporate world after achieving this fantastic business dream.

But it’s just that, a dream.

62% of small businesses today have no staff… Let that sink in for a second.

This means that the majority of small businesses today are run by one one person, the owner.

This isn’t usually by choice either, it is generally a requirement for a business to get off the ground before hiring help to limit the startup capital invested. (This is a debatable choice for the highly competitive niches that abound, but that is another topic)

A Business For Any Market

Our business model is designed to be the most efficient and cost-effective way to make money in any market, here’s how:

- It doesn’t require large amounts of money to market.

- This business model isn’t something that must have employees.

- It can be worked from home.

- You don’t need a College or even a High School diploma to understand this business model. (Although it might speed up the learning process some)

- This business model is already heavily researched, tried and proven. You don’t have to wonder if this is in demand, it most certainly is! (Most businesses fail today because they didn’t determine if there was a demand for their product. That’s why we make it a point to note how popular business loan brokering is)

- 2020 was a tumultuous year for many businesses in the US alone, but even before Covid-19 hit, businesses were using loans through brokers.

- We are the most comprehensive and affordable system available to learn how to become a business loan broker.

How Do I Get Involved?

We always refer interested people to our 70 minute training video before they enroll. It is paramount that you watch the video. (We tried to condense it as much as possible. There is so much valuable information we wanted to explain to the newcomer)

That being said, if you aren’t willing to watch a video this long, you probably aren’t cut-out for this business. This isn’t a glorified sales video, this is a training and presentation. It covers the fundamentals and complete overview of how our students make thousands of dollars every week with this “blueprint.”

Hopefully that isn’t an instant turn-off for you. Assuming you are interested and have a good work ethic, you are definitely going to appreciate that video. (It will also give you an opportunity to schedule a call with one of our coaches. Someone who will be able to discuses moving forward should you pursue this “Business Lending Blueprint.”)

An Opportunity To Be Part Of The 10%

It has been said that 10% of the world’s population controls 90% of the wealth in the world. Whether that is true or not, it does paint a fascinating picture of how money is flowing today. It isn’t the employees that make the most money. It isn’t even doctors (because they pay such high taxes). The successful entrepreneurs are the ones who manage to achieve levels of wealth that the world envies.

The stereotype that rich people are greedy or selfish simply isn’t true. There are rich people and poor people who have equally bad character. Money is just a tool, and our Business Lending Blueprint is the car that gets you to you dream destination. All you have to do is be dedicated enough to push the gas pedal. (The car won’t move by itself)

Join me and start creating the life you want to live!

Join the revolution!

Regards

Oz