A huge misconception in the business world is that a person’s personal credit is the same as business credit. It isn’t! (Even if you are a sole proprietor or LLC with one member) Our business credit building program is designed to help anyone start building corporate credit the right way!

Without direction, what seems right can be completely wrong for your business. How many times have you heard the stories about businesses failing within their first year or first 5 years? Well, much of that is due to a bad credit score or a lack of initial startup funding.

Our students learn how to surpass the status-quo and become experts in the field of business credit.

Maybe you are trying to build corporate credit, or are a lending broker and want to be able to help your clients get the funding they need? Then you need the kind of training that we are offering!

Common Problems That Businesses Face With Their Credit Score (Infographic)

Business credit was never meant to be complicated, but because of how commerce and business history has evolved, it can appear quite convoluted. In fact, this is one of the reasons that we teach our students how to properly identify whether a company is “established” or if it’s a “startup.” Based on their credit score and business history, they may not be able to get the kind of funding that they want.

That being said, a rookie mistake is to send a client away without first attempting to improve their credit! There are simple and safe ways to do this, and it can be a highly profitable process!

There are a few credit-related problems that are common for the average business today. (This is also a reason many of our students join our business credit building program)

- Their business information is mixed up with another business’.

- The number of years they’ve been in business isn’t documented or listed correctly.

- Identify theft has created a breach in their online security, potentially damaging their credit.

Is There A Solution?

Yes! Thankfully, as the internet has grown, so have online solutions. Although there is certainly no end to the deceptive practices of hackers and cyber criminals, there are new security practices available.

In terms of information being mixed up or listed incorrectly, we teach how to get a business’ information updated quickly. We aren’t about long,tedious processes that don’t deal with the root issues. As a loan broker or business owner, the goals is to ensure the continuity of operations. We want the business to keep going!

That’s why so many online businesses fail today. They lack demand and proper structure. Startups are told that all they have to manage is expenses, when there are actually many other responsibilities.

Responsibilities like:

- Hiring help.

- Expanding operations.

- Dealing with economic related issues. (2020 saw millions of businesses close down permanently)

- Online presence, even if primarily a physical business.

- Taxes.

- Human Resources.

- Product creation.

- Customer service.

- Sales.

- Marketing.

- And much more.

What Do All Of These Business Aspects Have To Do With Their Credit Score?

Everything! When you realize just how much a business is dealing with on an ongoing basis, you quickly realize just how valuable having a broker can be! Instead of having to learn what they qualify for, what is impacting their credit, and which lenders they can work with, a broker does this for them!

It is important that you recognize the mindset of a business operator, they want to get things done as quickly and effectively as possible!

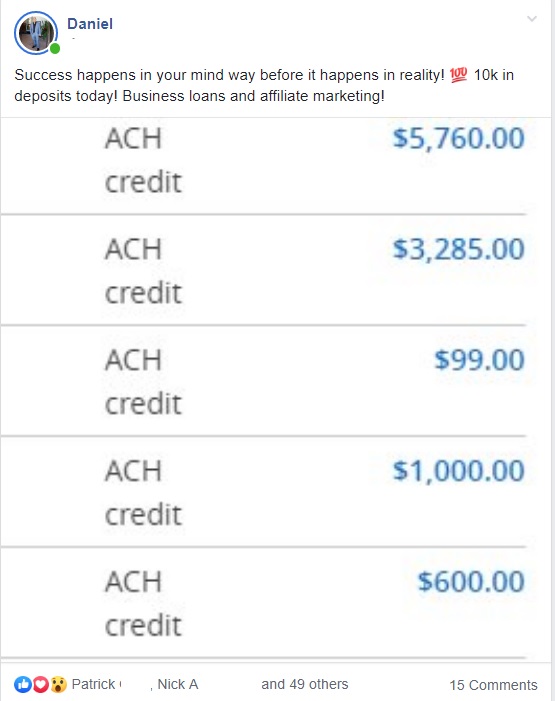

When I first started out as business lender, I quickly realized that there was so much more money to be made as a broker than I ever thought possible. It was a revelation to get my first commission and close a deal.

Suddenly, a business taking on a loan was more than a random occurrence. Suddenly I realized just how vital this service was!

I decided to show people how to become business loan brokers. Today, I have taught thousands of people how to do this! Many have quit their jobs and started their own businesses based on my “blueprint.”

Now you might be wondering…

Does This Mean There Is More Competition Now As A Loan Broker?

No, not really. In fact, many of our loan brokers have become veterans who help others close their deals! We give our students access to our broker communities, where many students collaborate with each other to structure deals! Solving problems as a new loan broker can be daunting, but we offer more help and support than anyone in this industry.

Our coaches are experienced, attentive, and highly professional. We even give you options to structure your business!

- You can do it yourself.

- You can have us run your business.

- Shadow a mentor as you learn the ropes.

Because of how we’ve developed our systems and learning resources, many of our students (on average) make money within 30-60 days of enrolling.

This isn’t rocket science either. People with hardly any formal education have picked this business model up and made more money than they ever thought possible!

Why Choose Our Business Credit Building Program?

Because we aren’t “BS-ing” you. We are honest about how this business model works and aren’t making false promises. If you are willing to put in time, this Blueprint will work for you. We have the testimonials to prove it.

I created a FREE 70 minute training video that details everything you need to know about this opportunity. (Which isn’t even that long all things considered)

I highly recommend you go through that, and I encourage you to take notes. Motivation is temporary, but your reasons may not be. You might have an excellent reason for starting a business, but passion without structure is a beautiful house without a foundation.

The moment the tide comes in, that house is gone. I’m not saying to build your house on a rock, I’m saying that your business should adapt to any situation!

We teach our students how to build a “recession-proof” business. One that works in a good market and a bad one.

Start building a business like no other! Click the button below and get started today with our business credit building program!

See you on the other side.

Regards,

Oz