Did you know that 69% of American entrepreneurs start their businesses from home? And did you know that in 2019 over 90% of businesses in the US were made up of small and medium sized corporations? The big corporations are the exception, not the majority. Because of how prevalent (or pervasive) the internet has become, starting a business has never been easier. That being said, a big obstacle that startups face involves acquiring capital to get off the ground. Here at BLB, we teach how to solve people’s problems by building a six figure credit repair business.

But what does that look like? Well, it doesn’t involve you turning into some kind of bank or credit agency. It involves you having the right connections and lending options to solve your clients’ problems.

How do we do that as an individual? Do we need a license? Do we need a commercial office building and a full team? Today those questions are answered!

Is It Viable Building A Six Figure Credit Repair Business? (Infographic)

Here are some common questions about a credit repair business model:

- If we aren’t the ones doing the credit repair, is it really profitable?

- Is it better to have multiple businesses rather than just focus on one?

- How do I know there’s a demand for loans or that this business model really will work?

- How many deals do I have to close to make this a viable business?

- Will this really help people? Is the focus on helping people or making money?

- How did business lenders and credit repair specialists fair in 2020

Here’s an infographic we designed to shed some light on this topic:

How Do We Help Businesses Repair Their Credit?

Glad you asked! The answer to this is pretty simple.

We don’t!

The meaning of the word broker can be summed up in one simple phrase:

“Bringing buyers and sellers together for profit, making everyone happy.”

In the case of repairing credit, a business with a poor credit score is probably trying to get a loan (hence the reason they need credit repair) which is where we come in! We provide them lending options for bad credit scores and we even have contacts that can help repair credit scores entirely.

At BLB, this is something all of our students learn and put into practice within their first month no problem.

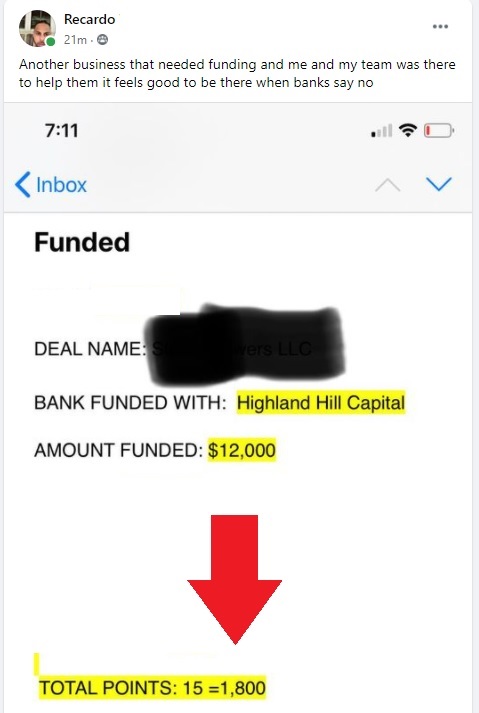

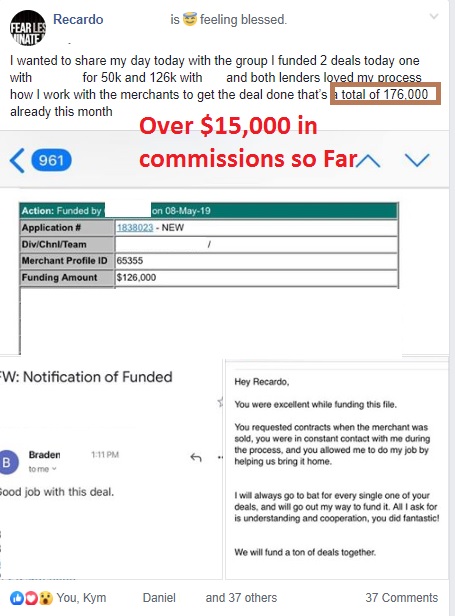

Is This Really The Most Profitable Business This Year? (Testimonials)

When millions of businesses closed permanently in 2020 (due to the lockdowns and Covid-19) you better believe that companies around the world took whatever route they could to stay afloat. Taking out a loan and using a broker to structure that online loan became highly popular. This business model was already popular before, but now it is more than speculative, or “nice to have”.

Now Western society realizes how fast you can get a loan with an independent broker instead of a bank. A bank can take weeks to approve a business and get them the loan. An independent broker has a multitude of lending options which means he can get them approved with money in their hands within minutes! (it isn’t always that quick, but lending brokers are usually way faster than banks and have a higher chance to approve a business)

The commission made on a deal is usually proportionate to the amount of money that is being transferred via the lending option. So small deals will have smaller commissions while really large deals will have bigger commissions.

But a one-time commission is just one strategy! (You can make recurring commissions off of a deal!)

Ways To Profit On Deals (Lending Options)

So there are two primary ways to structure the deal. You can structure the deal for a one-time commission or create a passive income based commission plan, making money on a regular basis with the deal.

The precise “lending option” that you will use are dependent on the company you are working with, their credit score, why they want the money, how much money, etc. We actually made an in-depth article about some of the lending options you can use at the link here.

You Don’t Need A License To Do This!

Businesses around the world have realized the power of an affiliates and referrals. Personalized offers are synonymous with the world’s largest marketing campaigns, and referrals are among the top ways to turn a prospect into a paying client.

Because businesses want to drum up new business as effortlessly as possible, they welcome the help of brokers who can bring them clients! (And they are more than happy to pay brokers a fee for this service)

The reality is, there will always be a demand for brokers. Everyone wants a middleman, and every business wants to make more money. If you can connect a need with the solution, there is value to that.

What Is The Business Lending Blueprint?

Simply put, it is a tried and proven system designed to take anyone of any experience or education level, and turn them into business lending brokers who can make a lot of money.

As I already mentioned, this kind of business model is incredibly popular, in-demand, simple, and highly effective. This isn’t rocket science, and on average, our students make profits within 30-60 days of enrolling. That isn’t speculative or guessing, that is a fact, and we have testimonials to prove it.

This is an opportunity for you to start changing your life in a way that is generally reserved for the super-wealthy. Unlike other programs, we don’t believe in charging you over $20K just to learn the course. We offer you valuable learning resources, coaching, contacts, flowcharts, and so much more.

We genuinely want to see you succeed because it means that we succeed. You don’t have to hire a bunch of employees or freelancers to see this business model work either. You can do it on your own, set your own hours, and start seeing results with the formulas we teach you.

In fact, we are so confident that you can succeed with us that we designed a training that is just over an hour long, and give it to you for free!

Join the recession proof business lending brokers today and build something amazing! Start building a six figure credit repair business today!

Regards

Oz