Are you looking for low risk SIC codes for businesses? Want to avoid high risk industries? You’ve come to the right place!

Today we’re going to cover essential information about the best SIC codes out there. And we’re going to cover how to avoid getting declined for an SIC code.

Let’s get right into this.

Low Risk SIC Codes For Businesses

Any industry that isn’t classified as high risk or part of the “auto-ban” list, is going to be “low risk” by default. Let’s discuss which industries have the highest risk, and which ones will automatically be disapproved for a SIC code:

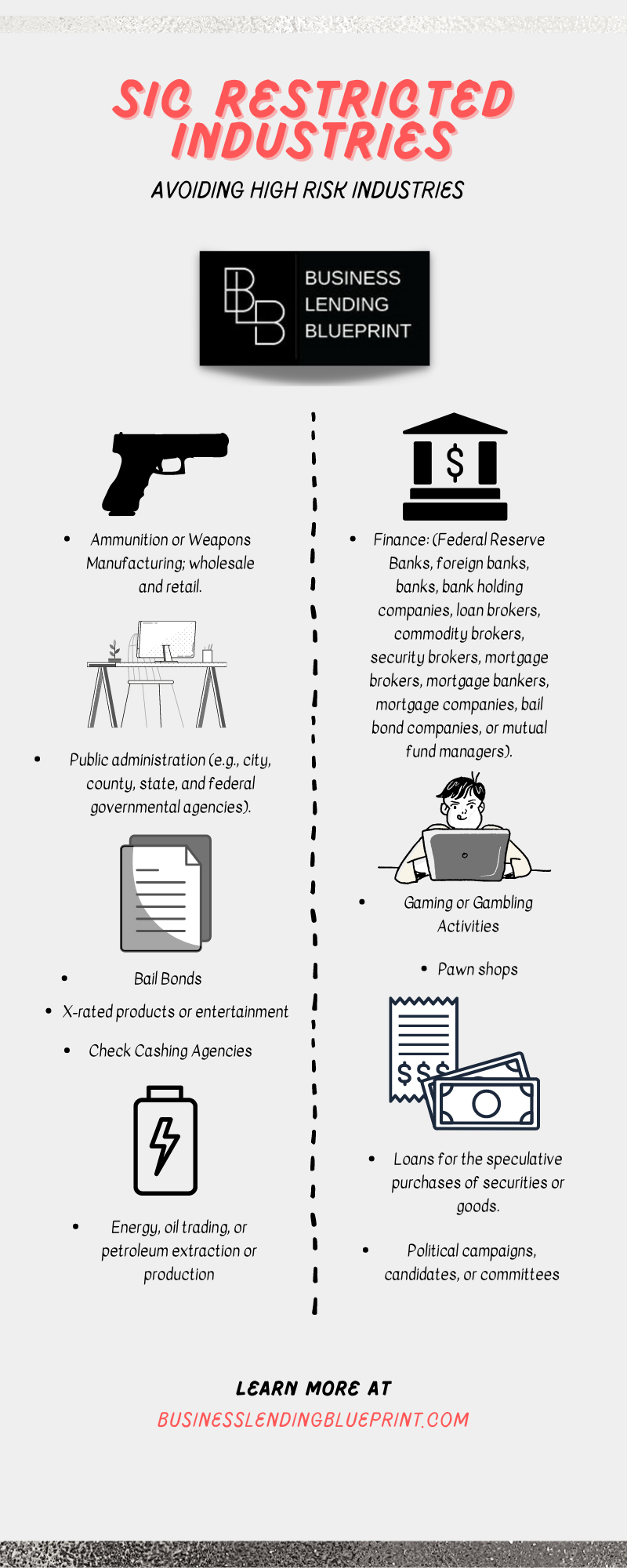

Automatic Disapproval Industries:

If you are in any of the following industries, you are not eligible for a SIC code assignment:

- Ammunition or Weapons Manufacturing; wholesale or retail

- Bail Bonds

- Check Cashing Agencies or other cashing companies

- Loans for the speculative purchases of securities, goods, or risky items

- Pawn shops

- Energy, oil trading, or petroleum extraction or production

- Federal Reserve Banks, foreign banks, mortgage companies, bail bond companies, mutual fund managers, banks, bank holding companies,loan brokers, commodity brokers, security brokers, mortgage brokers, or mortgage bankers.

- Political campaigns, candidates, or committees

- Public administration (e.g., city, county, state, and federal governmental agencies).

- X-rated products or entertainment

- Gaming or Gambling Activities. (Related to putting bets on money)

Remember that SIC codes don’t mean an industry is profitable. Finding low risk SIC codes for businesses is only beneficial for research purposes. If you’d like to learn how to build a “recession-proof” business that makes 6-7 figures a year from home, then click the link here to get started!

High Risk Industries That Can Be Approved

These industries are considered higher risk but can still be approved in some circumstances:

- Agriculture or forest products (Most because agriculture isn’t as popular any more)

- Auto, recreational vehicle or boat sales. (This is because the income car dealerships receive isn’t usually residual)

- Entertainment. (Adult entertainment is considered restricted).

- General contractors. (That’s because most contractors are being outsourced by bigger companies)

- Gasoline stations or convenience stores. (These are also known as c-stores)

- Healthcare; specifically nursing homes, assisted living facilities, and continuing care retirement centers.

- Special trade contractors

- Phone sales and direct selling establishments

- Software or programming companies

- Taxi cabs (including the purchase of cab medallions) .

- Travel agencies

- Hotels or motels. (Because this industry has greater chance of liability or damage being incurred)

- Courier services

- Computer and software related services.

- Dry cleaners

- Jewelry, precious stones and metals; wholesale and retail.

- Limousine services

- Real estate agents/brokers

- Real estate developers or land sub-dividers

- Restaurants or drinking establishments.

- Long distance or “over-the-road” trucking.

- Mobile or manufactured home sales.

What Factors Make An SIC Code ‘Risky’?

The US Government issues SIC codes for identification purposes. One of the primary factors considers is funding. Does an industry have easily attainable funding or is it considered risky?

Questions like these determine whether an industry is “risky” or not:

- Does the industry have a difficult time getting funding from traditional banks or lending sources? If so, they are less likely to get a SIC code.

- Are the business activities legal or illegal? Illegal activity is not going to help your chances of getting an SIC.

- Will companies be doing ongoing business or does your company serve a specific need that won’t last? (Each industry has an assigned SIC code) Each industry needs to have established necessity)

How To Apply For An SIC Code?

There is no need to apply for an SIC code. Remember that codes apply to specific industries, not individual businesses. You most likely already have an SIC code that relates to your company. You can search via the SIC Code directory which lays out everything you need for quick access.

Remember that knowing your SIC code is an excellent way to quickly help money lenders and credit reporting agencies about your industry. Once you know which one applies to you, keep record of it.

If you aren’t able to find an SIC code related to your industry, try contacting support and see if they know which one it is.

How Does An SIC Code Impact A Business’ Credit?

A company that has an SIC code has several advantages over other businesses:

- Any company that has an SIC code falls under a legally recognized industry. It vindicates your operations as legal commerce.

- An SIC company makes it easier for creditors to evaluate your credibility. This means they are more likely to approve your business for loans.

SIC Codes & ‘NAICS’ Codes Now Being Used

The Office of Management and Budget (OMB) created the North American Industry Classification System (NAICS). They created NAICS to replace SIC codes. The US Government adopted the NAISC in 1997. It is now as common as SIC code. The US still recognized SIC codes. The United States government treats SIC codes and NAISC codes equally currently.

Both types of codes remain valid today. The NAISC will become the only recognized code once legislation passes in the future. (This is also because SIC still has a massive database)

Opportunity To Make Money With SIC Codes

Many companies need good credit to function. 2020 was a year of turmoil in the commercial sector and private sector. Millions lost their jobs and many companies shut down permanently. It is paramount that creditors and lenders are able to see a company in a positive light. Credit repair has never been more profitable today.

That’s why we at BLB are teaching people like you how to become loan brokers who make profit off of credit repair. Companies seek credit repair is because they either need a loan or they are seeking special financing. A company that is unable to qualify for a loan needs credit repair.

We have created a 70 minute training video you can watch for free. It presents all of the information you need to take advantage of this opportunity.

Conclusion

Would you like to learn how to build a 6-7 figure business off of credit repair? How would you like to do that while working from home? Then you need to watch our free training video right now. SIC codes and NAICS codes are worthless if your business isn’t recession proof. That’s because in the next recession like 2020 more businesses are going to close gain. We teach you how to build a business that is recession-proof!

Click the button below right now!

Start your journey to massive profits. Gain financial stability like never before!

Regards,

Oz