Credit repair isn’t exactly a new concept. The idea of helping increase their “credibility” (credit score) is more or less just presenting facts in an attractive way. When someone asks, “why should we lend you money?” the appropriate response is to highlight the reliable history of your business in question. Lenders aren’t interested in your religion, your background, or your upbringing. They want to see a track record of reliability in your business operations. What many brokers don’t know, however, is that we can capitalize on these kinds of services, becoming the middleman, and making profit. Today I will teach you how to make 6 figures by offering credit repair services.

(And it can all be done while you work from home)

Do I Have To Be Certified? Is This Really Viable? (Infographic)

Did you know people are making a full-time living with a business that does nothing but make money on other people’s accreditation? Affiliate marketing is the most common example (selling someone else’s product for a commission) but the more prevalent examples of brokering a deal are those that involve a non-certified party connecting the lender with the needy party. This isn’t an original idea, this kind of business is conducted around the world, and has been around for quite some time.

“A good leader is not necessary the one with all good ideas; but able to build from other people’s ideas and always give them credit and acknowledge their contribution.”

― Dr. Lucas D. Shallua

People will bring money to their level, even when it requires a legal component. (Creative money making)

That’s the strange thing about money. It is just a tool, and a transaction doesn’t always require a legal prerequisite. (You don’t have to be legally certified to make money in this business model)

Online lending has become incredibly popular (especially since 2020) after so many businesses needed money to stay afloat. (And 68% of small businesses had outstanding debt (loans) in 2019. A percentage that has definitely increased today)

This Is 100% Legal. It Happens Every Day

Remember how I said the broker will connect a lender and the needy party? Well, that broker doesn’t have to be certified to lend money because he isn’t the one lending it! The broker simply gets paid for connected both parties together. Everyone ends up happy with the money and or deal they desired.

The same applies for credit repair. Here are Business Lending Blueprint, we equip our students with the contacts they need to structure virtually any lending deal. Part of this involves connecting your client with an institution or company that can fix their credit, and or simply get them the funds they need by verifying what they qualify for. (Remember, if the company doesn’t have to repair their credit to get the money they need, why even bother with that?)

But now I’m sure you are curious, “how do I know what my client can get for a loan?” And maybe you are also wondering how credit repair can really be profitable?

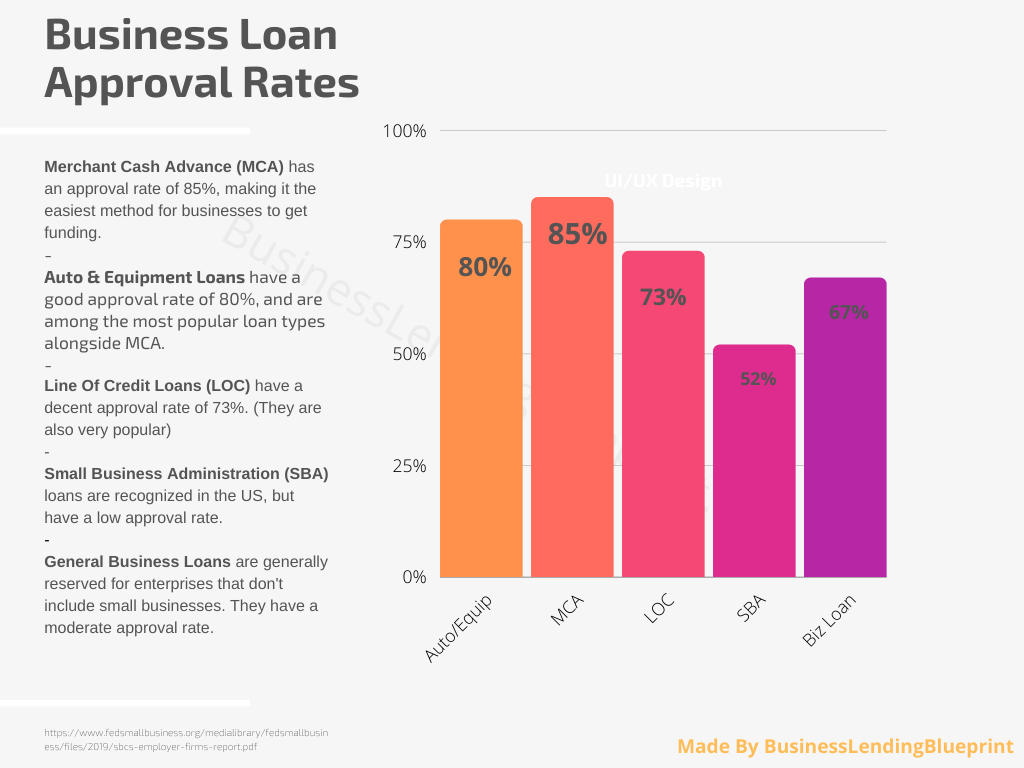

The Profit Lies In The Lending Option You Use

Because each client you work with will have different needs and sales history, the lending option that you utilize will determine how much money you can make. (Often the amount is proportionate to the lending amount, but residual commissions can actually increase this. Which is why we teach more than one time commissions to our students)

Credit repair is just a fancy term, don’t let it phase you.

If you really want to become a business lending broker, the technical details of brokering a deal need to be understood. Screening a client isn’t hard, but it can be complicated. Having the right options and the appropriate contacts will ensure that you can profit no matter the situation. (There are some rare instances where you simply can’t assist a business with a loan or credit repair, but 99% o the time you can profit on the deals)

There is a pronounced difference between an affiliate and a lending broker. One simply presents the opportunity to buy someone’s product, the latter acts as a middle man structuring the deal so that they get paid. Is that more complex? Yes, slightly. But unlike affiliate marketing, you don’t need thousands of sales to quit your job as a lending broker. If you truly want to know how to make 6 figures by offering credit repair services then you will be excited to learn how easy this can be.

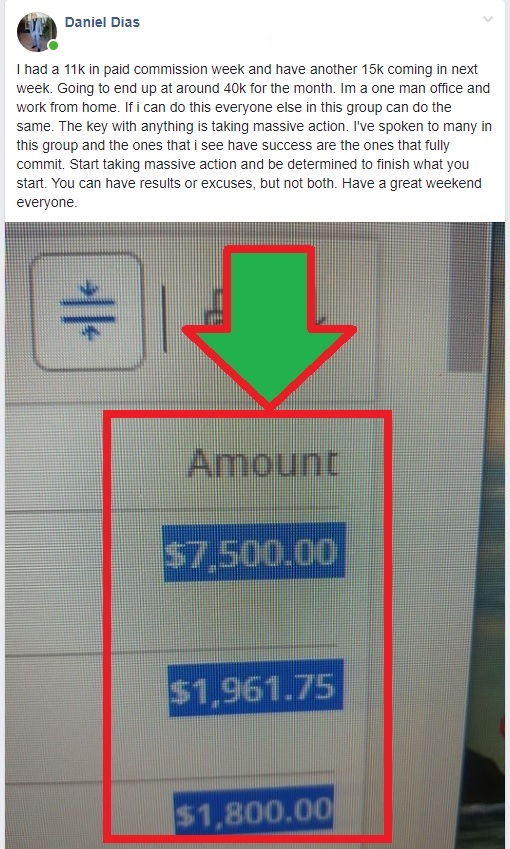

Our students have often achieved a 6 figure (or even 7 figure) report not long after enrolling. (Most profits and sales are made within 30-60 days of enrolling in the blueprint)

How Will I Know If They Need Credit Repair Or Not? (Is That The Right Lending Option?)

That’s something that we teach here! All of students know exactly who their clients should be in contact with to guarantee that they get the money they need, and they’ll do it so that the deal pays them as the broker.

There are fewer concepts than buy and sell. The difference here is that it isn’t a product, it is a service. A service we aren’t selling, and we don’t own it. We service a need in a creative way that is effective in a good market or a bad one. That’s why we stand by our belief that this is a “recession proof” business model.

In a good economy, businesses need credit repair and loans. In a bad economy, businesses need even more credit repair and bigger loans!

Maybe you are still on the sidelines though? Perhaps you are unconvinced that this is a legitimate way to quit your 9-5, feeling that this couldn’t possible be safe or effective? Well it is, and we have the testimonials to prove it!

We Offer A Successful Business Model, Not A Robot

We aren’t guaranteeing this, (no business can guarantee success earnestly) but we can present a tried and proven method to become your own boss.

The speed you are able to make money with this is dependent on you. Again, the average is 30-60 days for our students to make money with this, but they had to work it.

If you have some prior experience in this niche, you could do this even faster (like a few of our more experienced students), but even if you took the average amount of time, that is still really good.

Why not give this a chance if you are interested? If we haven’t met, my name is Oz and I am the creator of the Business Lending Blueprint.

To give you a full overview of what this business model looks like, I created a 70 minute training video that I’m giving you for 100% FREE. Want to know how to make 6 figures by offering credit repair services? This video actually explains what this looks like.

Take advantage of this opportunity. We have unbeatable pricing compared to our overpriced competitors. (Most of them cost over $20,000 with hard to follow material. We give you fair tuition costs and a plan for success from day 1!)

Join the revolution! Become your own boss!

Regards

Oz