If you are reading this article right now, you probably want to know how to become a business loan broker. As a broker, you are hoping to make money, and as much as possible. (And if you are like me, maybe you want to help people too?)

Here at Business Lending Blueprint, we aren’t trying to complicate this business model. We are also fully confident in our tried-and-true techniques to turn your business lending career into a 6 figure cash flow machine. (Even 7 figures if you are like some of my students)

With this article you’ll learn how to start a commercial loan broker business successfully. I detail 4 key principles every broker needs to use, 6 proven marketing techniques all of my students employ, the outdated marketing methods you should avoid, 4 business lending opportunities/categories, some testimonials from my students and an offer to learn more about my free training.

Oh yeah, by the way, unlike companies that tell you to open a risky credit card to become a loan broker, our business model is safe and effective! (Our students see results in 30-60 days, and they didn’t have to open a credit card to do it!)

Before I get into my 4 key principles that every broker should use for incredible success, let me debunk what so many of my students were skeptical about. I want to show that my strategy is not your typical business model, and that you can see massive results within your first month using it! (Unlike many startups, which take years to see any profits)

Learn How To Become A Business Loan Broker With No Inventory, No Overhead, No Office, & No Employees, Just A Real Business

Many businesses aren’t what they claim to be. How many times have you seen someone selling their business model, claiming you don’t need a massive amount of money, a big office space, or employees, but seem like they are withholding something?

After years in business, I can tell you firsthand how frustrating it can be to find a business model that claims to be easy, but actually creates more hassle than it’s worth. Maybe you are already juggling your family life, your career, your health, and your finances. The last thing you want is to add another frustrating and time-consuming task onto your plate right?

I designed our proven system to create a safe and effective way for anyone to get started quickly as a business loan broker. Here are just a few reasons we have been able to turn thousands of people’s lives around, many of which are now making 6 figures a year:

- This isn’t a drop-shipping business or retail strategy. You need no inventory to make money with this system.

- You don’t need a huge office space with loads of technology.

- The costs to get started are minimal.

- You don’t have to become a manager to see success as a business loan broker! No employees! (Of course, you can always hire help when you are ready to scale your businesses bigger and bigger)

How To Become A Business Loan Broker – The 4 Key Principles That Every Broker Must Know

Here are the 4 key principles I teach to all of my members. They are simple, but highly specific:

- Know how to get high-quality leads.

- Have access to the correct lending options and lending options.

- Know how to get your clients funded and then get yourself paid.

- And finally, any good business loan broker has a coach!

See our Infographic about this:

How Do I Get High Quality Leads? Should I Buy Age Data? Direct Leads? Direct Mailing?

A common problem that brokers are facing today is the lack of marketing leads they have. One common strategy that many novice brokers adopt involves purchasing leads, client age data, and using direct mail campaigns.

I am generally against buying any kinds of leads or data for several reasons. In terms of effectiveness, they are statistically terrible and require large amounts of capital to acquire. What’s worse is that brokers can become embroiled in legal troubles depending on whether the client data you gained is on some type of “no-call” or no contact list!

Forget what you know about lead-buying and client age data, it isn’t worth it and it provides far more hassle than you think.

As far as direct mailing goes, let me break down the kind of problems that many face trying to run these campaigns.

These Lead Generation/Marketing Strategies Are Outdated

Here are my thoughts on direct mailing campaigns and other outdated marketing strategies I think you should leave behind:

- Direct mailing involves a lot of paper, and even more money to run. While the statistics may show that there is certainly a market out there for these campaigns, running this kind of marketing strategy is truly laborious.

- It was common a decade ago to see people putting out signs with their phone number on it. The problem with this tactic is that it requires you to be available on your phone even when you don’t want to be, buy the signs (which may get stolen or destroyed) and those signs don’t post themselves!

- Buying aged client data costs an extensive amount of money and is often not worth the investment. Yes, you might gain insight into some of a company’s history or qualifications, but this rarely addresses whether that business is really interested in a loan to begin with. Furthermore, you are not the only one contacting these people!

- Buying lists of leads or lead data. Similar to buying aged client data, when any kind of list or lead compilation is purchased, you have competition against anyone who already bought that list. You have little information about them (or outdated information about those leads) and the costs to buy this list are high.

What if I told you that there was another way to generate targeted leads that convert into buyers so that you can get started quickly and with low marketing costs? What if I told you I was about to share my 6 proven marketing strategies for free?

Our Online Lead Generation Techniques Are Simpler & Faster

There was a point not too long ago when accumulating worthwhile, highly targeted leads was difficult and costly, now it can be condensed down to an exact science.

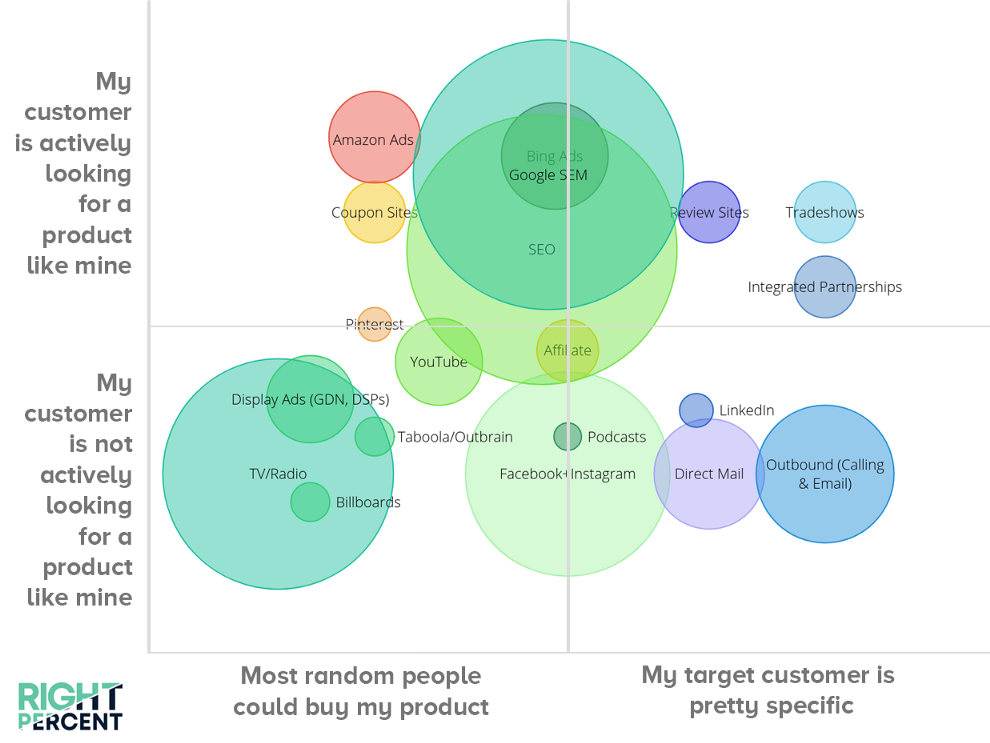

Because of how integrated the worldwide-web has become, it is easier than ever to find people in need of your services… If you know how to find them that is. Here is a graph that was created by an experienced marketer detailing how companies are marketing today and how they’ve been doing so for the last 10 years of his career.

(Notice how direct mail plays a small role compared to online marketing. Also notice how lead data and sign posting are nowhere to be found!)

There are several methods of getting high-value leads that my team and I cover in our comprehensive training.

Let’s get right into those now.

6 Proven Marketing Techniques To Generate Leads

Here are some of the primary ways that our students have become massively successful business loan brokers:

- Funnel clients to you. Every loan broker needs to focus on having deals automatically and organically coming to them, not just through marketing. I teach several simple ways to do this.

- Find the people or companies who already know the person you can help. Build a relationship with them and have them send you clients.

- Build trust and a reputation for solving problems! Trust is everything in this business model, and even the most earnest business loan broker will lose deals if he doesn’t have the right systems in place to meet a client’s needs. Basically, you need to become “that person”, people go to and refer their friends to. You solve their problems.

- Learn how to find people on social media who you can help. Advertising and building relationships go hand in hand in this business. (Linked In & Facebook are both incredibly powerful platforms and we teach about how to use them for lead generation)

- Email marketing has been around for years, but that doesn’t mean it’s lost its touch! Building email lists and turning a prospective reader into a client is golden.

- Become a superb consultant. Branding is something that comes after you’ve gotten your feet wet and you know what you are doing.

How Do I Become A Business Lending Broker That Actually Gets The Loan To My Clients?

Marketing is the backbone of every business. Without clients, there are no deals and no income from your business. But now that you’ve seen some of our strategies, maybe you’re wondering about another important aspect of becoming a business loan broker?

“How do I source the funds I am going to provide to my clients?”

After years of experience in the field, having closed a multitude of different deals, and working with many lending options, I can tell you firsthand how frustrating this aspect of being a loan broker can be.

Thankfully, I figured it out. I now teach what I’ve learned and have helped many avoid the pitfalls that I first experienced. A big part of the solution involves multiple lending options.

“What helps people, helps business.”– Leo Burnett

Among The Top 100 Most Influential People in the 20th Century (Time Magazine)

More Than One Lending Option?

A misconception about brokers is that they only work with one source for their loans. The experienced business loan broker will tell you that having only one source of funding doesn’t make sense. (I will explain why in just a moment)

Let’s say that you have fully screened the client that you are working with and you need to decide how to structure their loan. They need a loan to purchase real estate. Certain lending options are better suited to deal with loans for real estate than others. And some options simply will not work at all for them.

Why Multiple Lending Options Are Needed

Certain loans will not work for some businesses. While one lending option is suitable for a startup, another is for an established business with something to leverage. (Or existing revenue history) here are some of the reasons that you need different ways to structure loans for your clients:

- Their credit score might not be high enough. (Some lending options require a certain credit score)

- If they are a startup, or haven’t been in business long, they may not have any revenue.

- The amount of money they are requesting might be a hindrance. Having different options to structure large and small loans is important. (Big difference between $15,000 & $150,000)

- Some lending options are only possible for companies that have been operational for a minimum period of time.

- The way a business processes sales can be a factor in finding the appropriate lending option. (E.g. They make sales through credit cards instead of invoices)

- These are just some of the various scenarios.

The differences between how you structure one deal can be subtle, but oh, so important.

Which Lending Option Do I Use? Filling The Gaps

Because I have been a broker for so long, I have found that there are certain lending options that fill a part of the playbook. Just like in the NFL, there isn’t just one play, there are always different strategies and resources.

As I progressed as a business loan broker, filling the gaps where one kind of option couldn’t help someone prompted me to find another lending option to do it instead.

The lending practices I teach cover a full-spectrum of different business loans; all of my students know exactly who to work with for each type of client/loan.

How Many Lending Options Should I Use?

As many as possible! We make this easy for our students and provide dozens of different lending options in our training, “Business Lending Blueprint”.

According to a survey conducted by FedSmallBusiness, 24% of all loans are through online lenders, not banks!

Because there are so many different factors to determine what a business qualifies for, we developed simple ways for every broker to quickly evaluate a client, get them the loan they need, then rinse and repeat. We teach our students how to handle virtually every kind of loan. Here are just a few scenarios that our students know how to handle.

A Few Of The Scenarios That We Train Our Students For:

-

A Business Is Looking To Buy Equipment

Whether it’s for a tractor or a new office setup, businesses are always in need of funds for these kinds of buys. This one is tricky. One might assume that a business’s credit score would be more than sufficient to justify purchasing equipment, but this isn’t the case.

If a business needs funds for equipment, the first thing you need to find out is how long they have been in business! This way, you will know whether they can use their credit score to qualify for the loan, or if you have to use another method to structure the loan. Like I said, this one can be tricky unless you know how to do this broker deal.

The next example goes into greater depth to understand why a company’s operational history has such an important impact on what kind of lending options you can use.

-

A Client Wants More Money Than They Might Qualify For

A “Credit Score” is actually a reflection of someone’s or an entity’s “credibility” (hence, “Credit Score”), and because the longevity of a business reflects that, finding out how long that business has been running is the first question.

Why? Because according to Finder, which listed a study by the Small Business Administration (SBA), the average loan in the United States was $663,000 in 2017. (Across all categories and business sizes)

What this study doesn’t immediately reveal, however, is that this average isn’t a very good reflection on how much money that small businesses actually apply for. Again, the data reflected is an average across big businesses and small businesses alike!

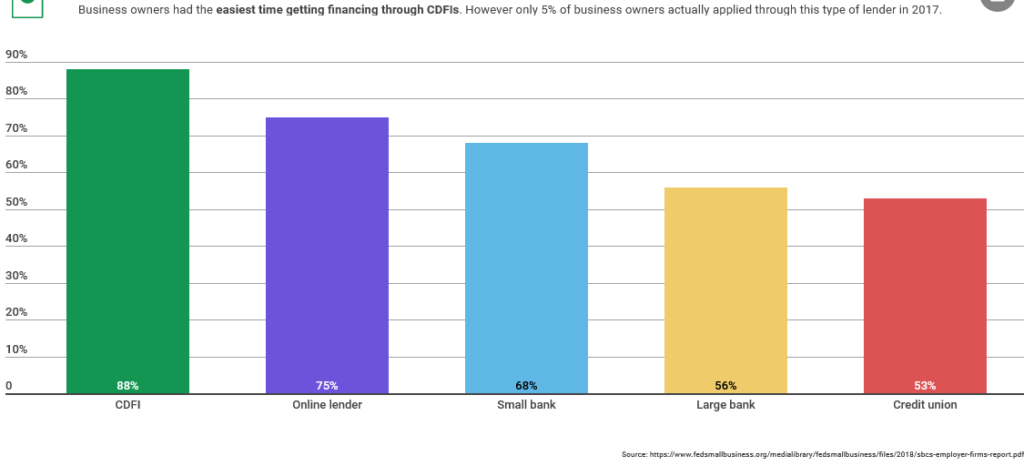

According to that article, more than half of all business loan applicants applied for $100,000 or less. Article also reported that clients had nearly a 20% better chance of getting approved by an online lender than with a large bank! (Online lenders also beat out small banks by nearly 10%!)

See this graph posted by FedSmallBusiness to see the approval chances/percentages for each lending source:

And it isn’t just because those small businesses didn’t want more capital. Startup businesses have a cap on how much money they can take a loan out for before we no longer have a lending option for them. (Banks and other lending institutions want to see credit history or operational history, something startups can’t always provide)

While there are certainly lending options that work for startup and established businesses alike, the amount of money in the loan that they are requesting may only be available for established businesses. We provide training on how to handle these leads and decide with 100% certainty whether you can or cannot help them get the amount of money they want.

-

An Established Biz Is Trying To Get A Business Loan ASAP

Once you, the broker, have properly screened the client and confirmed that they are an established business, the amount of money that they want becomes a lot more flexible, but the loan option you use will depend on how quickly they need the money.

So finding out when they need the money will dictate the lender and the option you use. (Another reason multiple lending options are important, not every lender provides funds as fast!)

There are a number of reasons that a company might need funds quickly. It could very well be that the company in question needs to hire extra help due to a surge in business! A study (conducted in 2016) was re-posted by FinImpact stating that 81% of small business enterprises had no employees. (That percentage is calculated out of 30.7 Million small businesses!)

-

The Client Wants To Purchase Real Estate Only To Refinance It

A business looking to buy real estate is a category in it of itself, but it may be a surprise to learn that their reasons behind purchasing the property is something you must take into consideration when deciding on the best lending option.

In this example scenario, the client wants to purchase property to refinance it.

This is perfectly fine and doable. There are loan options available for business clients who want to purchase real estate just to refinance it for the worth.

Yet, there is a subtle difference that you must remember and account for. A loan to a business entity is different from a personal loan to an individual.

Unlike an individual, a business entity operates out of an “office space”. If the business claims that they are going to live in the real estate that they are going to purchase, we as brokers are unable to finance owner-occupied Real Estate.

-

After Evaluating A Client, This “Established” Business Would Actually Count As A “Startup” And They Want A Large Loan

Isn’t this an awkward situation? Our students are given the information they need to determine whether their clients are “established” or “startups”.

When it is clear that the client doesn’t have the income history, or the company lifespan necessary to qualify for a certain amount of money, what then?

Our course is designed to show you exactly what kind of lending options are available and who you need to work with to structure this deal.

These are just a few of the dozens of different kinds of situations that a knowledgeable, properly equipped business loan broker can make profitable!

How Many Different Kinds Of Loan Opportunities Are There?

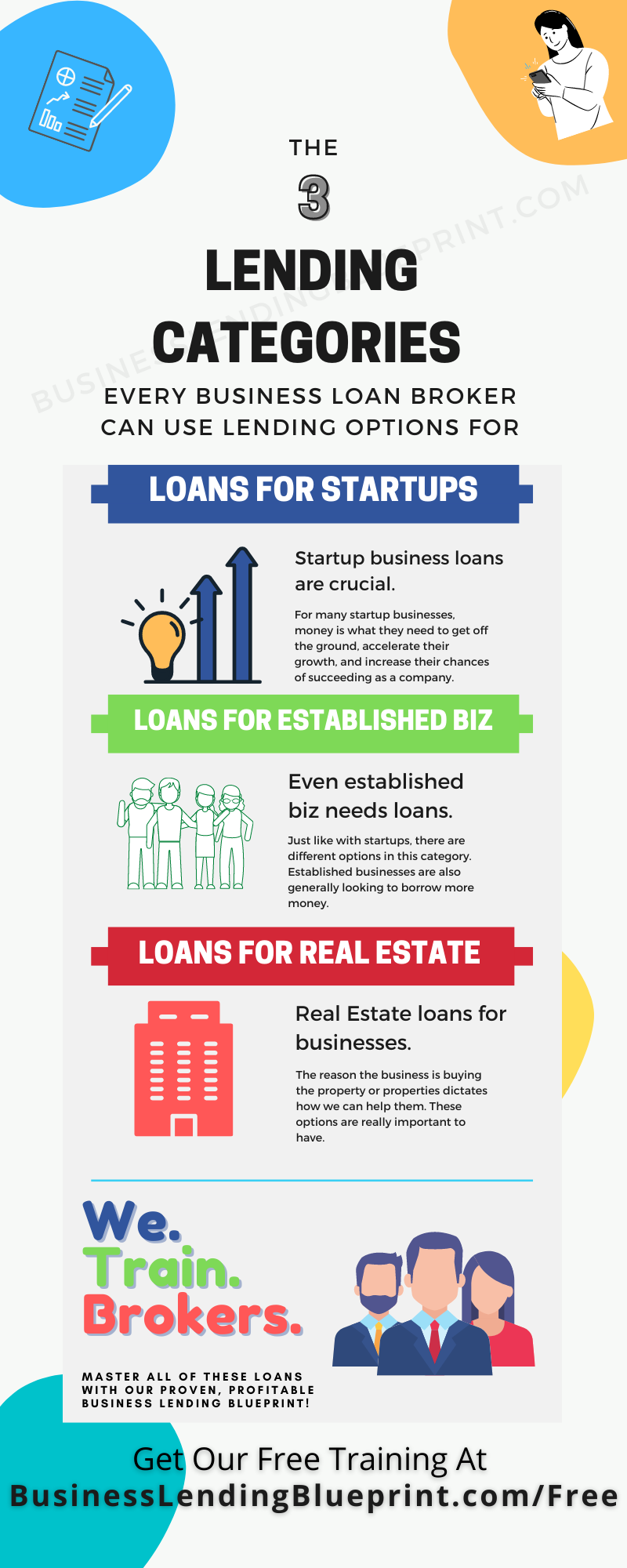

There are probably hundreds if not thousands of different kinds of loan opportunities out there. Categorically, we can simplify the different kinds of loans down to about 3 primary categories. (There could be more, but the numerous lending options we teach work to structure deals for the following loans)

Here is an infographic that lists the 3 different lending categories. (Again, there are many options we teach to structure loans for all of these):

These are just a few of the kinds of loans that a business loan broker can make money on. Depending on the client’s situation, a different lending option will be used. The following opportunities are by no means the only kinds of deals you will come across, but to give you an idea, here are just a few of the kinds of loans our students structure.

3 Loan Categories A Broker Can Capitalize On With Lending Options

- Lending to startup businesses. For many startup businesses, money is what they need to get off the ground, accelerate their growth, and increase their chances of succeeding as a company. There are multiple scenarios and different kinds of applicants, so having the appropriate loan option is important. There are also limits to the amount of money that a startup can apply for. Knowing when a client is beyond the scope of a standard business loan can save you a lot of time and effort. This is something all of my students are taught.

- Lending to established businesses. Just like with startups, there are different lending options in this category, and credit is just one financial factor that we take into consideration. Established businesses are also generally looking to borrow more money. Unlike startups, however, the amount of time that a business has been in business plays a role here. (By the way, did you know that unless a business has been around for a minimum amount of time, it should still be evaluated like a startup?)

- Lending to businesses looking to buy real estate. It may come as a surprise to learn that while a lending group may offer loans to businesses that are interested in purchasing real estate, the reason the business is buying the property or properties dictates who can help them. This means that only certain loans will work for a business to buy real estate. The option is going to be different depending on what that business intends to do with said real estate.

How A 50/50 Chance Of Success Becomes 100% Proven

Many new business loan brokers have a strong will, an excellent work ethic, and a desire to improve. Yet, in 2019, a study by the Bureau of Labor Statistics shows that about 20% of small businesses fail in their first year, and about 50% of small businesses fail in their fifth year.

To put that in perspective, that means you have a 50% chance of creating a business that makes it past its first 5 years. (And the profit margins aren’t usually great for these average startup companies) What is even worse is that many of these small businesses close either filing bankruptcy or find themselves with a serious amount of debt!

Can you succeed on your own? Yes. But would you rather take an enormous gamble, trying to figure everything out on your own, or would you rather adopt our proven system which continues to create recession-proof businesses for business loan brokers every year?

How We Turn Our Members Into Rock Star Business Loan Brokers – 9 Steps/ Resources To Teach You How To Become A Business Loan Broker

- Training. We use a multifaceted approach to our training modules.

- Legal documents and proven scripts. It is hard to sound professional and generate success when you don’t know what it looks like!

- We provide the Partners and Direct Lenders you will need to get your deals fully funded! (This saves time and makes it possible to see quick results!)

- Lending options, resources and strategies that are safe and effective! (Not to mention recession proof!)

- I have weekly calls with my members to get them off the ground and answer their questions!

- We have thousands of people on our private Facebook Group; those who are looking to work with other business loan brokers or those who have questions use it regularly.

- What good it is to be a part of a community that has a life-span? We offer Lifetime Phone and E-mail support with no extra fees. This way, anyone and everyone can get immediate help. (It solves the problem of information without direction!)

- We give our members a Flowchart with step-by-step instructions to fund deals quickly and do it repeatedly!

- COACHING! We believe that having access to like-minded people is important, but sitting down with someone who is already living the life you want is critical to success! (Tiger Woods says his coach is the reason he is such a skilled golfer!)

Who Is This System For? Can Anyone Really Learn How To Become A Business Loan Broker And Be Successful With It?

I have developed a system that anyone can be successful with. You don’t have to have sales skills or have a history of selling something. During an interview with one of our students, Adam, he shared how he had made over 1 million dollars in a year using the Business Lending Blueprint.

When asked if he felt that some prior skills were necessary to see success with the system, regardless of how much success they achieved, he didn’t feel like there was any reason that someone couldn’t generate results.

“The sales skills… and also the product that we’re selling and the fact that we’re selling money, it sells itself. You don’t have to be extremely versed in sales. When I initially started doing this, I had studied and learned for so long before I actually started taking action and taking the calls and getting in there and seeing how the conversations were going. And the biggest takeaway that I had was man, I should’ve just started doing this earlier versus getting so overwhelmed with, ‘Oh, I’ve got to know all this stuff.’ To me, I feel like I could take almost anybody and give them a 15 minute descriptive.”

More Testimonials!

Another member, Lina, shared how she wished she had used our system earlier. She shared she did not know just how successful she could be with it and mentioned that she got deals within the first 4 weeks she became enrolled.

“But I only regret waiting this long. I’ve waited for months and you know, I really could have just saved the money a little more. And you sit around going, ‘Oh, it’s too much. Oh, it’s too much.’ It’s not, it’s never too much to invest in your future. And this is a program that doesn’t take months or years to work. This works within the month. I haven’t even been a member for like four weeks yet, and I’m already getting deals. So this is worth it. It’s worth it for your family, it’s worth it for your future. And that is what I have to say, and I hope I steered you in the right direction.”

And this isn’t just about volume either. One of our members, Daniel, funded $500,000 and made $40,000. That was a net profit of $40K. He didn’t have any expenses or overhead to cover with that money, so it all went into his bank account. Talk about a win!

A Community & Training Like No Other

We are the largest training program in our industry. We provide more than training, however, we also provide everyone access to our online sharing platform! This means that anyone and everyone can get feedback from our members in real-time. (There are currently over 2000 people in the community)

A perfect example of how this community feature proves so invaluable is with one of our members, Aaron. Unsure of whether a prospective deal was worth his time and effort, he asked the community whether it was a good idea and how he would go about structuring it. (Aaron was dealing with a customer looking for financing an office building… and he didn’t have an enormous amount of information beyond that)

Another reason that our community has proven so powerful is that it puts so many like-minded individuals in the same space. There are team-ups or collaborations going on regularly every day, providing new members and veteran members opportunities that they normally wouldn’t have.

I’m Offering A Business On Cruise Control, Not Autopilot

I have created a 70 minute training video that dives deep into how I can turn anyone into a successful business lender. (Just over an hour) But I don’t just give them career-specific skills; I teach them how to build a business. Usually a workshop only covers one subject and tells you to enroll in another. My free training cuts out all that nonsense and gives you the opportunity to get everything you need to make 6 figures a year, and do that repeatedly!

Like I said, this isn’t some “get rich quick” scheme, and I’m not trying to hustle you. Everyone is different and has their own reasons for wanting to start a business as a business loan broker.

Does this describe you?

- You realize that your 9-5 isn’t giving you the financial future you imagined.

- You want to travel more, buy more, do more, but money is seemingly always tight.

- Creating a backup plan for your family requires more than a job, you want to build something stable.

- You want to be your own boss.

- After years of toiling, you aren’t looking for another job; you want an actual business.

- You’re unfulfilled with your work and you want something you can be proud of. (And that your family can be proud of too!)

- Last but not least, maybe you just want to make significantly more money. Probably more money than you are making right now, and financial freedom is a bonus?

If any of these describes you, then your “why” is definitely compatible with this business system I have developed.

My Free Training That Has Taught Thousands On How To Become A Business Loan Broker!

I have created a 70 minute training video that dives deep into how I can turn anyone into a successful business lender. (Just over an hour) But I don’t just give them career-specific skills; I teach them how to build a business. Usually a workshop only covers one subject and tells you to enroll in another. My free training cuts out all that nonsense and gives you the opportunity to get everything you need to make 6 figures a year, and do that repeatedly!

Like I said, this isn’t some “get rich quick” scheme, and I’m not trying to hustle you. Everyone is different and has their own reasons for wanting to start a business as a business loan broker.

Does this describe you?

- You realize that your 9-5 isn’t giving you the financial future you imagined.

- You want to travel more, buy more, do more, but money is seemingly always tight.

- Creating a backup plan for your family requires more than a job, you want to build something stable.

- You want to be your own boss.

- After years of toiling, you aren’t looking for another job; you want an actual business.

- You’re unfulfilled with your work and you want something you can be proud of. (And that your family can be proud of too!)

- Last but not least, maybe you just want to make significantly more money. Probably more money than you are making right now, and financial freedom is a bonus?

If any of these describes you, then your “why” is definitely compatible with this business system I have developed.

The Business Lending Blueprint

Click Here to get your free training video today or click the button below. Success waits for no one, but right now, I am giving you the opportunity to catch it with a zip-line. All you have to do is a latch on and hold tight. You’ll find me right next to you 100% of the way.

Join the revolution, become a hyper-successful business loan broker with my Business Lending Blueprint!

Oz

Become a small business loan broker

Become blb

I’m ready to become loan broker

I’m curious whether there are any unique difficulties or barriers that recently licenced brokers may encounter. Hearing about some actual experiences or advice for getting through such obstacles would be beneficial.