Many businesses are started by using the business owner’s capital. (32% of new owners use their own money) If they don’t have the funds to support their business with cash, they look to outside sources for startup capital. But what many new owners realize shortly after applying, there is a big difference between having business credit vs personal credit. One is based on a businesses’ performance, the other is based on the net worth and previous credit history of an individual.

That may come as a surprise to those who are more familiar with how a corporation functions (since it is essentially an “entity”, the same as a person) but there are differences. Specifically, a business’ credibility is usually determined on its sales and time of operation.

Whereas an individual’s credit score has many factors that are unrelated to his job or how long they’ve held a job.

Businesses today are not in the market of creating a revolutionary product, they are in the market of solving problems. You can have the shiniest, most impressive product out there today. But if the product doesn’t meet a need or demand, it is probably not going to sell very well.

Assuming a business has something that is in demand, they may not need a loan to cover expenses. In fact, 68% of businesses today have an outstanding debt, and that debt isn’t always a sign of desperation.

Loans are often used to take a successful business and make it even more successful. But maybe you’re wondering how to build commercial credit to get said financing?

So What Is The Difference Between Business Credit Vs Personal Credit?

Before going into the nitty-gritty of how a business increases its credit score, it should be noted that this list is by no means a source of legal advice or something that can be cited for legal counsel. This list is purely informational and exists only to enlighten the reader on how a business’ or a person’s credibility is calculated.

To preface the details about how personal credit and business credit are calculated, it might help to understand what constitutes a business “entity” from a person.

Business Entities In The Modern World

Basically, a business entity or “corporation” is a strategic legal course of action which outlines who owns specified assets, and who has a right to control those assets.

(Ignoring the fact that something might not actually be an “asset” despite being given that description)

The funny thing about corporations is that they are generally used to limit liability, and are treated like a person when formed. (E.g. As in the case with an “LLC”, which stands for “Limited Liability Corporation.”)

As stated by Investopedia.com, corporations originated in America as early as 1790s. They existed in the 19th century in other nations, but America took “legal negation” to a whole new level.

Although public opinion towards corporations plummeted due to the Stock Market Crash of 1929, corporations have always been ideal. Whether it is to minimize the potential for legal problems, or to maximize profits by separating personal reputation from one’s operations, corporations are the “go-to” strategy.

In fact, America dominated commercial trade through the forming of corporations until the 1980s. Japan was among the first to take notice and implement a way for entrepreneurs to create legal entities. There was little to no competition from other countries for hundreds of years prior to this.

This is why older Americans remember the 1950s as a golden period of opulence and industrial progress.

America really was the land of opportunity. Opportunities that the world had never had before.

We are so confident about this market that we are offering a FREE training to learn how to quit your job by becoming a lending broker.

Now that we understand why corporations are formed, and how auspicious they can be, let’s talk about credit scores.

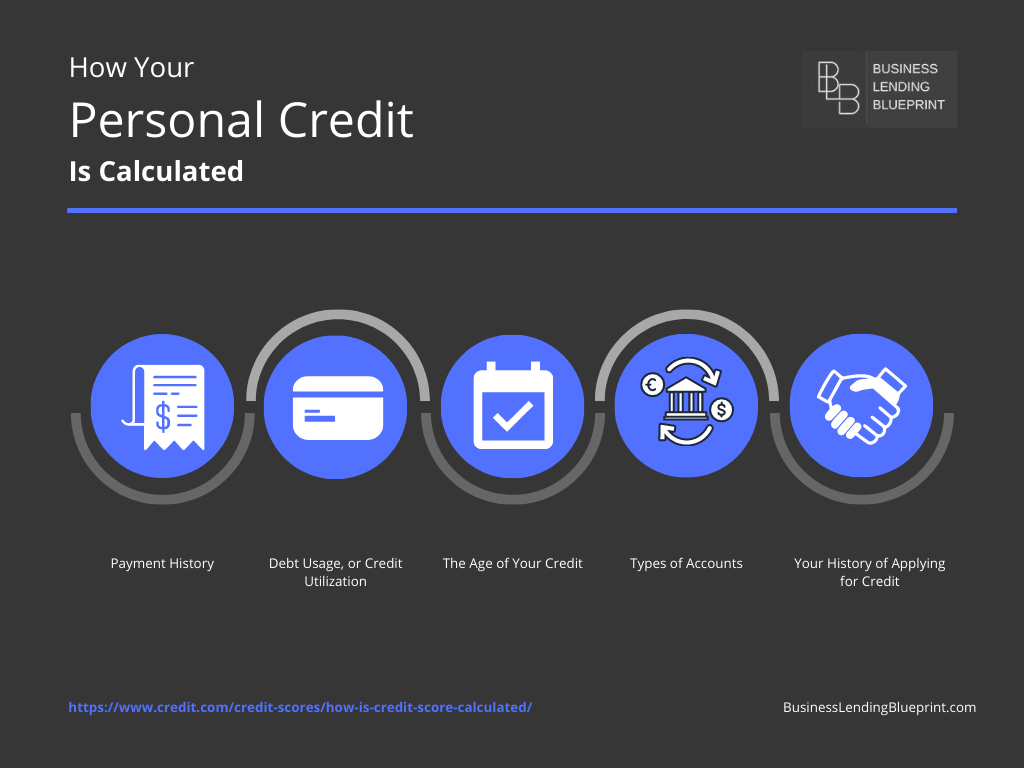

The 5 Primary Ways Personal Credit Is Calculated + Infographic

According to Credit.com, personal credit has 5 primary factors that impact someone’s calculated score. To help give clarity on how this is done, we at BLB created an infographic outlining this process:

- Payment History. This is at least 35% of your score.

- Debt Usage, or Credit Utilization. This composes about 30% of your score.

- The Age of Your Credit. This isn’t about how old you are, it is about how long you’ve had credit accounts. (This data makes up 10-15% of your credit score)

- Types of Accounts. This makes up about 10% of the credit score.

- Your History of Applying for Credit. This influences around 10% of your credit score.

How Business Credit Is Calculated. (4 Factors)

Business credit is calculated similarly, except a business entity, unlike a person, serves a specific purpose. A critical point to note is that a person’s life can have many purposes and everyone’s character is different. A business entity (although it can hold the same legal rights as a person sometimes) only exists on paper. Because of this, a business’ credibility is not based on how many kinds of accounts it has, or how long it has held a business credit card.

A business’ credit score is calculated through these 5 key factors:

- Sales. How many gross sales are the business making.

- Age of the business. There are “established” businesses, and there are “startups”. The difference is that one has been around for longer than the other. (And naturally upstanding business will usually have an excellent track record of sales)

- How much property does it have to substantiate a loan amount? (Real estate, vehicles, and other valuable assets listed under a business help boost its credit score)

- Previous credit history or loan history.(Although this isn’t an enormous factor that is used, it has some weight associated with it. If a business has successfully handled a previous loan, it is a good sign) Of course, businesses change, including their sales. That is why this isn’t as important for a business’ credit score.

As you can see, time is not quite so important compared to a business’ performance. It isn’t worth much if a business has paid 10 loans but doesn’t have a good sales record. (This will also impact whether a business is treated as an established business or a startup, even if that business has been around for 20 years)

The Reason That A Business Wants A Loan Also Affects Its Eligibility

Because not every loan is the same, certain amounts of funding may not always be given to certain businesses. A perfect example of this is when a business wants funding to buy real estate. If the business doesn’t qualify as an “established” business, then it may not be able to get the money it needs.

Certain amounts of money are reserved for more reliable businesses, whereas any business classified as a “startup” may not have a track record of success.

The Same Goes For Personal Loans, Defaulting Is Rising With Interest Rates

This is actually similar to how some individuals can qualify for bigger loans because of their net worth or income level. Those with less income won’t usually qualify for gigantic loans. Even if they can muster up enough for the payments, that isn’t reliable in the eyes of the lender. (E.g. Taking 70% of your bi-monthly income and spending it on the loan payments)

Should an emergency arise, or an issue occurs with that person’s income, how are they going to afford the loan payments?

And as it turns out, 5.2 million people defaulted on their student loans in 2019. It isn’t just students though, imagine how many businesses defaulted on their loans in just 2020 after so many lock downs in the US?

The same goes for those who had rent to pay, mortgage payments due, etc. The economy isn’t always so peachy as the public is told. This is also the reason why interest rates across multiple industries have increased. Forbes believes that mortgage interest rates are going to continue to rise and there doesn’t seem to be any deterrent in sight.

How To Build Commercial Credit

While it isn’t uncommon for a business to perform well, many people make the mistake of never creating a corporation around their business, which means they aren’t totally building commercial credit. Any assets listed in a person’s name are treated as personal property. Therefore, personal credit is being built, not necessarily business credit.

Of course, if you have a record of sales and assets that can be leverage, creating commercial credit can actually be as simple as starting an LLC, S Corp, C Corp, etc. (As long as there is some kind of business entity handling operations to some degree, you can build commercial credit.)

What Business Corporations Are There? + Infographic

Brex.com did a wonderful job of outlining the differences between the corporations. Taking a note from that article, we’ve created another infographic listing the different corporation types.

The Western world uses the following 6 primary corporations. Those include:

- S Corporations

- C Corporations

- Non-Profit Corporations

- Limited Liability Companies (LLC)

- Sole Proprietorships

- General Partnerships

How Does This Apply To Building Commercial Credit?

Simply put, commercial credit is only going to apply to businesses that have a certain legal structure. A Non-Profit Corporation is not going to qualify for the same loans that an S Corporation will. This is because a non-profit doesn’t claim any profits and therefore has no record of sales. This affects that corporation’s credit score tremendously.

Most of the corporation types can still qualify for similar loans to one another. This is because lenders are less worried about a company’s legal negation of liability, and more concerned about whether they can pay back the money that was given to them.

It is kinda like how lenders don’t really care about what job a person has, and more about how much money they make annually.

However, many businesses today are ignorant of legal structures and may not even realize the danger that they can put themselves and their partners in by taking a loan.

As with a General Partnership, defaulting on a loan means that you’ve just brought your partners down in to the same dangerous situation that you are in. (There are potential risks and rewards of taking a loan)

When getting a loan, be cautious and think things through.

So What Is The Strategy To Improve Commercial Credit? (The Lending Process)

Lending is a pretty simple process today. There are essentially 3 phases of the lending process:

- Apply For A Loan

- Seek Approval For The Loan

- Finalize The Loan

Except for having to wait for the loan to complete, these are really the 3 steps to getting a loan.

But the second step is the one that is the most difficult. Getting approved for a loan means that everything has to fit a specific criteria and standard. The lending option that is used by a lending broker (or by the business directly) is going to depend on a few things.

Why the company wants the money, how long they’ve been in business, and their sales records are some of the primary things to consider.

The main issue that businesses are struggling with isn’t usually bad commercial credit, it is a lack of understanding. Sure, you might have the best commercial credit score, but which lender or lending option is suited for your company?

This is why loan brokers are among the world’s most in-demand specialists currently.

It is also why we here at Business Lending Blueprint teach how to become a commercial loan broker.

Improving Commercial Credit Differ From Personal Credit Improvement

Remember how we said that a business’ performance is more important than their previous loan history? Well, the same can be said for how a business improves their commercial credit score. The only way to increase commercial credit is to increase performance and potentially the assets your business has.

(Assets work as a form of leverage. Businesses use assets to support itself sometimes.)

A $100,000 loan is common today. A $500,000 loan is rarer. It may come as a surprise to learn, however, that the amount is less important than the aforementioned factors used to determine the commercial credit score.

In many cases, once a business is considered “established”, a record of sales that substantiates the monthly payments is really the most critical factor at that point. The amount is often an afterthought for lenders because it just means a longer loan process.

This means they can lower interest rates because they know they could make more interest on the bigger loan. (And most businesses request around $100,000 on average anyway)

How Business Lending Brokers Are Indirectly Improving Companies’ Commercial Credit

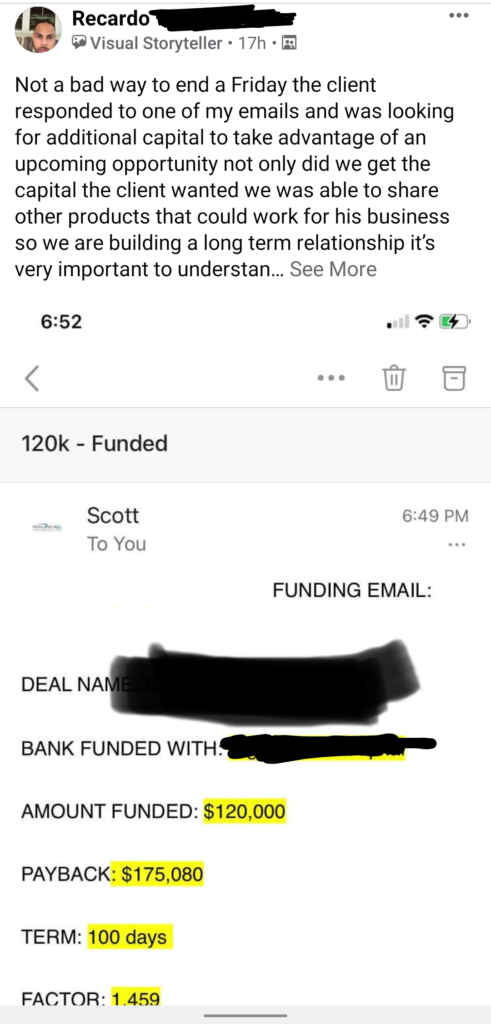

Because a company doesn’t necessarily need to increase their commercial credit to qualify for loans, the solution to acquiring more funds is often as simple as having a broker connecting them with the right lender. Lending options are a common term in the lending brokering niche.

(The above example shows how our student Michael helped get a business funding)

When we have more lending options, we can help more people.

This is where a company and a broker differ. A corporation prioritizes profits and operational stability. A broker prioritizes having the right lending options and structuring the deal to make the most money they can on the deal.

The corporation doesn’t have the connections that a broker has. A broker needs money to continue their services, so there’s motivation to succeed. This is a mutually beneficial exchange, but only recently becoming more popular. Indeed, after the events of 2020, many businesses closed or resorted to external funding.

Online funding has a higher approval rating than traditional banks. (Nearly 80% approval rates) Online lending is also becoming more convenient since they can structure the entire process through the broker to get the perfect lending option.

Because they cater this process to where a business is at the time of needing the loan, commercial credit scores may not actually be as big of a problem as some institutions claim.

How Does Business Lending Blueprint Teach How To Become A Commercial Lending Broker?

If we haven’t met, my name is Oz. I am the creator of the “Blueprint”. A proven system that provides everything someone needs to make money as a business lending broker. (Often in 30-60 days from the day they enroll)

We optimized the system to learn the most important principles first, then dive into the technical details of the deal. The blueprint also includes support groups, mentors, and coaching calls that happen every month. We want our students to succeed. When they do, we win too!

A huge drawback of technology that many people face is a surplus of distractions. A recent study shows that the human attention span fell from 12 seconds (as was stated in the year 2000) to 8 seconds today.

But we all know that these statistics are only relevant to topics that we aren’t interested in. (Ever watched a movie that was 90 minutes long, or went on a nature hike that fully captured your attention?) When we do something that we like, we can do it for hours on end without a problem.

The inherent problem with business systems today is that they aren’t engaging and don’t capture people’s attention well. And why would they? People don’t usually get excited about a boring business.

Pursuing your passions is generally the best motivation. Your motivation can also just be for the money. (And pursuing one’s passions is a major reason that people start their own businesses)

Is Business Lending Blueprint For Me?

That’s the funny thing about business opportunities, many of them will work and make money. The biggest variable is the person who runs it. There is certainly variation in the market and on how people consume their wants and needs. But that change isn’t usually volatile.

Remember, a business isn’t usually part of the stock market. People aren’t buying and selling your business or the option to buy it. When a business “goes public”, it gives the option for people to become shareholders. This can be good or bad, but that isn’t what we’re talking about.

We are talking about whether a business, regardless of its niche, is something you want to work on.

Make no mistake, a business is usually another job, even if it is just part time. Rarely will you find a business system that needs a button pushed and then runs autonomously. Most businesses require your effort to work. There are differences between a 9-5 job and a business. An example would be the amount of money that can be made. Compared to business profits, commission-based salaries are limiting. But with a business the amount of money you can make is infinite.

Naturally, breaking a barrier in gross sales or marketing success is an ever present battle, but the rewards can be above and beyond amazing.

Passions Or Money? (Maybe Both?)

That is the reason people start businesses, but it helps if you are passionate about what you’re working on. Some people only need the money to motivate them. (Some our students don’t care for being a business loan broker but love the promise of making more money than their jobs)

Is it easier to work on something that you are passionate about?

You need to decide what kind of person you are and what motives you to work on something that may not reap huge rewards immediately. (Jobs usually pay faster, but there is a cap on how much money you can make)

An Opportunity To Help Businesses And Make Money While Doing It

I’m not promising that you will make money in this business or any business. Even if you have the right motivation and passions, businesses take time to grow. There is a big difference with our blueprint. The Blueprint is already complete.

Having a proven business system makes running it so much easier. This system makes it easier to see profits fast. (FYI, making profits within 30-60 days of enrolling in a course is super fast!)

f you want to build something that will support you through hard times & allow you to quit your job, this is for you.

This is the recession proof business, and we take pride in knowing that we offer unparalleled value in this specialized field.

Join using the button below and watch my 70 minute FREE training which outlines everything you need to know about this business model!

Regards

Oz