There are many reasons you may be reading this article. It could be to find out what a business loan broker opportunity looks like. Or maybe you want to know how to sell merchant cash advance? Either way, the two are essentially part of the same strategy. Using a lending option to meet a business’ needs while making profit.

The term “lending option” refers to the lending source and kind of funding that is used. Merchant Cash Advance (MCA) is a loan-type. It is actually one of the most popular and easiest methods for business funding.

The ease and speed that a business can gain lending today is utterly astounding. While not all lending options are done with lightning expediency, they are quite fast. (Many loans today only take a day to complete now)

However, many loans are not always available for certain businesses. Merchant cash advance is not always suitable for certain loans. (Especially if that business is a startup)

So with that being said, let’s talk about how to structure a business loan broker opportunity the right way. (The most profitable way! Many of our students make 6 figures a year doing this!

Taking A Poor Business Loan Broker Opportunity & Making It Profitable

Loan brokers today are often learning merchant cash advance for the wrong reasons. There is a fine-line between being a specialist and a one-trick pony. The specialist gets the job done. No matter what strategy they use, a one-trick pony can’t adapt.

Here at Business Lending Blueprint, we teach our students to become go-to specialists; people who get the job done!

But becoming a specialist isn’t simply a matter of closing a deal, it is about making sure each deal is as profitable as possible.

Have you ever wondered how businesses stayed afloat in 2020 after Covid-19 hit? They stayed afloat because of business loan brokers like our students.

Merchant Cash Advance is a well-documented and proven way to get financing quickly for one’s business, but did you know that even established businesses may not need to use it, or shouldn’t? Having the right lending options can mean the difference between having a large payday, or being unable to help a client.

Should I Use Merchant Cash Advance? (Infographic)

Many of our new students ask about merchant cash advance. It isn’t an inappropriate question by any means. However, the real question they should ask is what lending option has more profits!

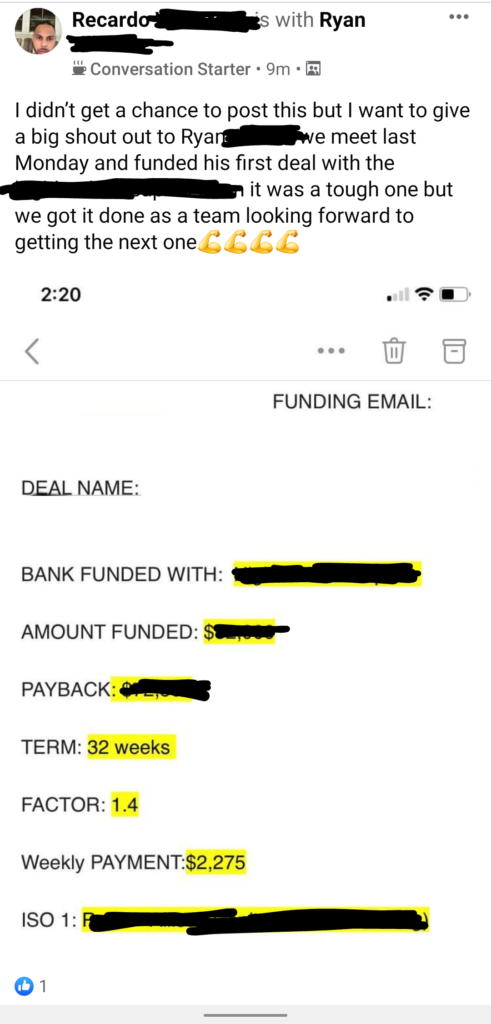

If you have any prior knowledge in this field, then you’re probably familiar with the profit structure of a loan broker. When a deal (loan) is finalized, there is a commission or a “cut”. That amount is determined by the type of loan, the lending option (MCA for example) and the negotiated terms. The latter involves picking whether a residual commission structure is a better choice than a onetime commission.

Maybe you haven’t heard of a residual, passive commission structure? It isn’t exactly a widely circulated topic. Nor is “passive income”!

Using Merchant Cash Advance isn’t about whether you “should” use it, using MCA is all about “when” it is best suited for the client.

Wait, Aren’t We Structuring The Loan Type For Maximum Profits?

Wait, Aren’t We Structuring The Loan Type For Maximum Profits?

Yes! But as fate would chance it, structuring the deal to suit the client’s need is actually the most profitable option!

It is important to remember that the client’s business and their needs dictate the option that is used. There is no other way to help a client except to use what is appropriate for their situation. A broker must have multiple lending options for this exact reason! The variables of the deal mean your options will be limited. This isn’t a bad thing. We teach our students to structure what appears to be a poor deal and turn into something that makes everyone happy!

Are There Deals That Make More Money?

There are certainly deals that make more money than others. The difficulty lies in finding the larger deals. When you find a button that always brings you high-ticket clients, let us know!

Assuming this is a business model that interests you, it is paramount that you avoid being picky. Nine times out of ten there is money to be made with a client. Some new brokers claim they can’t get enough clients, but the problem is usually with the broker. (We’ve had students turn away clients when they could fully be helped!) Missed opportunities should not be part of your vocabulary if you want to quit your job.

Our “blueprint” has allowed many of our students to quit their 9-5 jobs. They didn’t do this by being a one-trick pony or by being picky.

But We’re Brokers Right? How Do We “Sell” Merchant Cash Advance?

Selling something is a relative term. Our “stock” can be a service, a product, or even information. We aren’t living in the Industrial Age anymore, we are in the “Information Age”. (Credit Robert Kiyosaki)

Becoming wealthy in life isn’t about working “hard”, it is about working “smart”. Which is why we recommend starting the “recession proof” business model we teach! Anyone can start a business with our systems, and it is one of the most affordable startup businesses on the planet!

A loan broker is not even selling their services, they are selling money! The promise of money that a business needs is the “selling” point!

But you may still wonder whether there is a catch? Well, there is. This business doesn’t run on autopilot. This business model requires a time investment. We created a FREE training that covers everything you need to know. Everything you need to know about becoming a business lending broker.

Are There Situations When Merchant Cash Advance Is Better Or Worse?

Yes, there are situations when MCA will shine as the most outstanding way to source funding to your clients. There are also times when MCA is completely out of the question. That isn’t because the method changes, but the client differs.

We created a massive article outlining a variety of business loan broker opportunities that may present themselves. We listed ways to make them profitable and utilize the right lending option.

It suffices to say that businesses today are not improving their marketing, they are improving their “personalization”. Nearly 80% of consumers say that they will only engage in a marketing piece if it has been personalized with an offer that appeals to them specifically!

This means that a general marketing piece that isn’t specific to a person will only have a 20% chance of succeeding in most cases!

Merchant Cash Advance caters to a very specific demographic of businesses. It also only functions for certain companies if they qualify. To determine this, we must properly evaluate the client. We have created a thorough article discussing how a business’ credit score is calculated vs a person’s. That post may surprise you!

People Want Simple Steps

Becoming a specialist in any field is all about making funding easy to acquire. So many business processes today are too complicated. Buying something in a retail store is a perfect example of keeping things simple. Pick what you want, walk to the counter, pay for it, and go home. That is a simple process.

But the behind-the-scenes strategy is what consumers don’t see. The brand marketing, the sourcing of materials and stock, these are steps the consumer doesn’t see. When the business needs checkers, baggers, deli workers, bakers, or even a shelf-stacker, the consumer doesn’t see the hiring process.

A manager will know about these things, which is why it is probably the most annoying thing for a manager to be called to help a customer. They are already managing far more than a complaint or request from a consumer.

Here at BLB, we aren’t teaching you to be a store manager, however; we are teaching you to be a problem solver! There are no performance reviews, hiring screenings, or cleanups on aisle 5. We teach our students to be everything in a business that is way less time-consuming and far more profitable!

Lending Should Be A Pleasurable Experience

Have you ever purchased from a company and didn’t like the experience you had? Did you ever buy from them again? Probably not!

This is because online reviews, social media, and digital interactions with consumers have taken presidency in whether a consumer buys anything! According to this article, ConsumerAffairs.com. Buyers have become suspicious of brands, preferring to see whether or not they are authentic. How a brand interacts with its supporters is a major consideration for the average shopper now. (E.g. Do they have a YouTube channel, do they have positive reviews, or maybe have a person who interacts with their buyer base?)

What happens when a business loan broker offers an experience that induces dread or a lack of comfort? The buyer will disassociate from that broker!

The Perfect Shopping Experience (Example)

“There is only one boss. The customer. And he can fire everybody in the company from the chairman on down, simply by spending his money somewhere else.”

– Sam Walton, Founder of Walmart

Think about the perfect shopping experience. Visualize the incredible pleasure of perusing the items that you are interested in. You look into your purse/wallet and see that you have plenty of money. The store allows you to buy what you want, when you want it. You can leave when you want, and you can stay as long as you need.

This shop gives you A-Grade service, and it seems like you could be friends with everyone who helps you. When you find the item(s) you want, you bring them to the counter. Well, what do you know? They are on sale!

You finish your purchase without a problem. The payment processing terminal works flawlessly, they approve your card. You stroll out of the shop on what appears to be marble floors before exiting through modern sliding doors. Even the doors seem keen on giving you a positive experience as they open without a noise at record speed.

Slightly surprised at the doors working so well, you leave, happy to have entered the building, already thinking about coming back again.

How Does This Apply To Being A Business Loan Broker? (Proof Of How It’s Done)

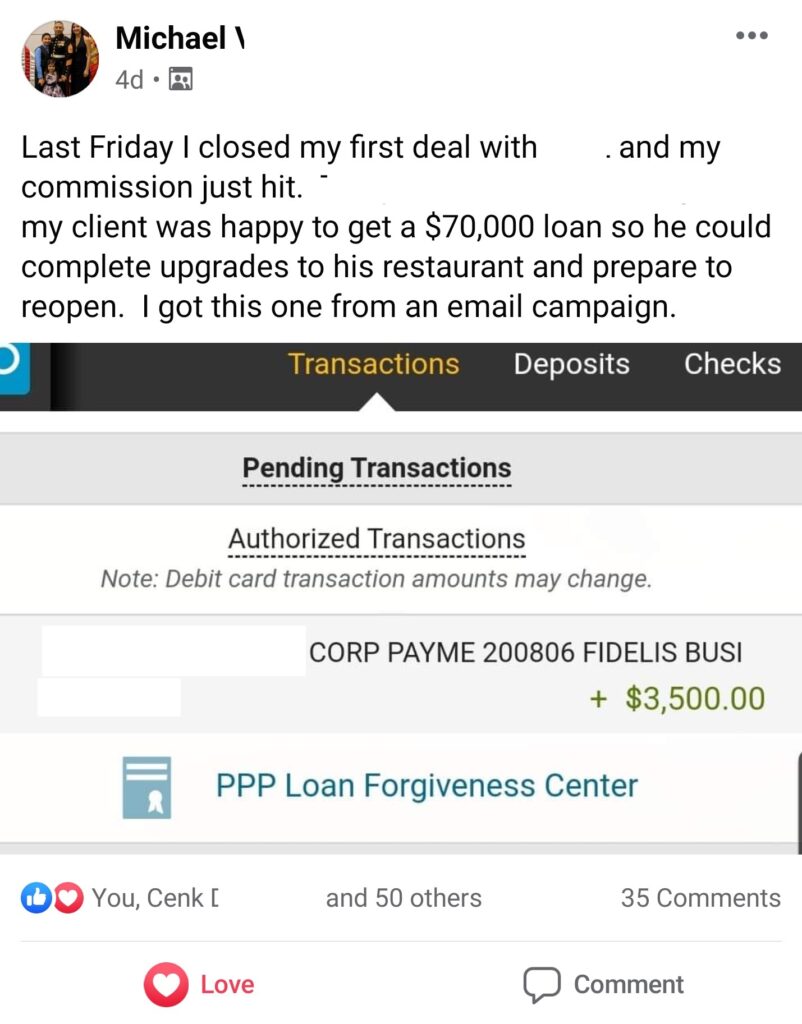

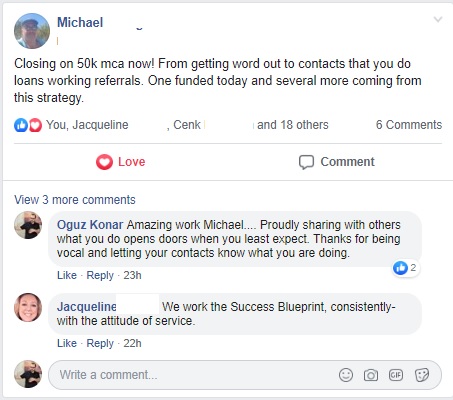

Now that you have an idea of what the perfect shopping experience looks like, can you see how this translates into being a successful loan broker? (The above student used our blueprint to make a client happy and get paid at the same time!

A business reaches out needing funds. You connect and make an excellent first impression. You imbue confidence despite what could be a problematic situation for the client. They need money, and they need it quickly. They don’t want to be taken advantage of, they don’t want their time wasted. The client needs their problems fixed.

At this point, the client is still in the shopping aisle, they are not yours. They have been in the shopping aisle before they connected with you, now they are evaluating whether to put you in their cart. (Remember, you are the broker and are the service)

We as brokers want them to go to the checkout register and move forward with us. The issue lies in the value that they perceive. Do they see you as their problem solver or a greedy person who’s capitalizing on their need for money?

There are more technical steps involved (of course) but there is a major difference between these two examples.

The client may not be eligible for a specific kind of loan or funding amount!

Its like someone trying to buy medication without the appropriate prescription. Similarly, different businesses require a different lending option to get the money they need.. (And 95% of the time you will be able to help them!) You are like that doctor giving them the prescription, you have the means to help them!

How Does Business Lending Blueprint Teach How To Find The Opportunities?

If we haven’t already met, my name is Oz and I am the creator of the “Blueprint”.

The idea behind this program was to empower people to quit their jobs with stable businesses. We teach our students how to build a “recession proof” business model. It is recession proof because it will always be in demand, it doesn’t require a physical location, and it is cheap to start.

The other reason that I believe this particular business model is superior to other startups is because anyone can do it. This isn’t a “semester” based model. You don’t have to study for years to do this.

Many of our students are able to make profits within 30-60 days of enrolling in the Blueprint.

Click here to get my FREE training video which details what you need to know about how to get started!

But What About The Economy? Wasn’t 2020 Really Bad? How Are There Still Opportunities For Startups?

Businesses around the world are started primarily for two reasons:

- To make money.

- To pursue a passion.

When someone wants something bad enough, nothing can stop them from getting it. The human will is one of the most powerful forces, and it is the reason why businesses made it through 2020.

Does that mean all businesses made it? Certainly not. There were many small businesses and even big businesses that weren’t able to take the lockdowns and quarantines. But while businesses were going under, business loan brokers were thriving!

When a business needs money, they are often willing to take a loan, even if it puts them in debt. The logic behind this is simple. It can be more lucrative to make it through a bad market turn than to capsize the investment.

Sometimes “patience” directly translates to getting a loan to cover expenses.

As mentioned before, it isn’t always about covering expenses, many businesses use loans to expand their successful operations.

How To Use The Blueprint

Although many business models claim to have all the answers, only a few even have a remote idea of what success in business actually looks like. Statistics show that an estimated 9.4 million businesses closed in 2020 at least. That doesn’t tell us that businesses are built for hardships, it says that they are highly situational. Similar to Holiday stores, or a seasonal service. If a business isn’t equipped to adapt to an ever changing market, how can it possibly survive?

Our blueprint makes it possible to sell the most in-demand item every single year. No matter whether it is a good market or a bad one, people want it. That product is “money”.

Being able to ride a wave of positive business growth is excellent, but most any business can do that. How does your business fare when it is in a bad market crash? If you are like most businesses, you will temporarily or permanently close like the 9.4 million did in 2020.

I don’t mean to brag about our business, but the sheer number of people who managed to create successful deals a loan broker in 2020 is astounding. We trained them to close deals, and those deals were fully viable even in a poor market turn.

But Isn’t there A Catch?

Yes, the catch is that this business won’t run itself.

Arguably one of the hardest parts of starting a business is actually making things happen. The reason the Blueprint is so effective is because it makes running the business much easier. No hired help is needed, it can be done by one person, the startup costs are low, and deals can be done extremely fast. (Not all deals close fast, but many of them do)

Have you ever been in a store looking for something and they didn’t carry it in their stock? Isn’t that the biggest turn-off to shop at that place? Well, about 95% of the people who you deal with can be helped. (That number is conservative since there are few businesses that can’t be helped)

The key to becoming successful in business isn’t necessarily just about closing deals, however. It is about making the client happy! If they feel that your services are valuable, then they will be recommended.

This isn’t just about having a feel-good experience, it is about making the shopping experience easier.

Statistics show that people are four times (4x) as likely to make a purchase when they have been referred by a friend!

Becoming The Go-To Specialist

It is imperative that you create a brand for yourself. Your reputation is important. This doesn’t mean you have to form a corporation or file a bunch of documents. (No certification is required to be a lending broker)

However, it is important to become someone that others can rely on. Being the middleman isn’t about making a quick buck.

Think about it like having a job. When you get employed, you are generally on your best behavior because you know that your job is on the line. The same applies in business, and it is the reason why this saying remains ever prominent in business:

“The Customer Is Always Right.”

If you can structure a deal well, make the customer feel that their needs were met and that you understand them, why wouldn’t they recommend you?

An Opportunity To Change Your Entire Dynamic

We don’t just teach business loan brokering at BLB, we teach how to become the boss you were always meant to be. Boss of your life, boss of your business, and boss of your future.

Not everyone is going to take action, which is why they don’t get results. If you are willing to take action, well, you are going to see results.

The cool thing about the blueprint is that it already works. Imagine a water pump, you don’t immediately see water flowing out of it upon use. But after pulling up and down, the pump brings up water. Sometimes the results are shocking, other times they aren’t.

It isn’t about becoming a millionaire in a day, it is about making a shift in the way you live and make money. (Passive income is a real thing and it is powerful!)

Join the revolution!

Become a business loan broker and quit your job!

See you on the other side.

Free training available here.

Regards

Oz

Wait, Aren’t We Structuring The Loan Type For Maximum Profits?

Wait, Aren’t We Structuring The Loan Type For Maximum Profits?